AIM13 Commentary - 2019 Q3

“Diligence is the mother of good luck.”

Recent reports of the planned WeWork IPO have reinforced (to put it mildly) what we have been seeing across the capital markets for the last several years. We are late in the cycle of this bull market, and we believe there is a widespread lack of discipline associated with these persistently frothy markets. Investors have a fear of missing out (FOMO) and are buying things without doing their homework. While we try to keep our letters family friendly, the dialog we have chosen below reflects our thoughts on the current state of investment due diligence (or lack thereof) and the accompanying levels of risk being taken by investors.

We have said many times that just because you got away with it does not mean you did not take any risk. It certainly worries us that investors are getting away with a lot these days, including less than adequate due diligence. What bothers us more, however, is when investors do not do their homework and then complain when things go wrong. The fact is that every investor has a choice, and investors need to hold themselves accountable for their decisions. In Lethal Weapon 2 terms, if you take the risk of going through the drive through and do not do your due diligence (i.e., check the food before pulling away), you cannot complain if you get screwed as a result – because as Leo Getz points out below, they will definitely screw you at the drive through!

WeWork: Lessons and Observations

We believe the failed WeWork IPO provides an important example of these dynamics. The office sharing company, conceived in 2008 by Adam Neumann and Miguel McKelvey, reached a peak valuation of $47 billion in early 2019. Its investors included Goldman Sachs and J.P. Morgan, and prominent venture capital firms like Benchmark. Its biggest backer, however, was SoftBank and its $100 billion plus Vision Fund that sunk nearly $10 billion into the company. In August 2019, WeWork filed for its IPO seeking to raise $3.6 billion.

“The Greater Fool Theory states that the price of an object is determined not by its intrinsic value, but rather by irrational beliefs and expectations of market participants.”

In September, WeWork imploded. Euphemistically referred to as “nonstandard financial practices” distorted the company’s true – and heavily indebted – financial position. Reports also surfaced of Neumann smoking marijuana on a corporate-owned Gulfstream and personally selling the “We” trademarks back to corporate for nearly $6 million. In October, the IPO was abandoned, Neumann was forced out with a mere $1.7 billion (!) severance package, and now Softbank values the company at $7.8 billion, representing a stunning $4.7 billion write-down on its investment.

The WeWork debacle provides some important lessons for investors in today’s markets:

Know what you are buying – or in Leo Getz terms, you need to look in the bag at the drive through window! According to a Wall Street report in early October, WeWork’s prospectus contained a number of glaring errors, omissions, and misstatements. For instance, the filing said the company delivered 273,000 new work stations in the first half of the year, and then an amended version a month later said it was 106,000. Likewise, there was no mention of the $60 million Gulfstream the company purchased. Ordinary investors should be entitled to rely on securities filings, and reports in mid-November indicate the SEC is investigating. However, primary research and due diligence are critical to every investment. Unfortunately, that takes time, hard work, and experience.

Actions speak louder than words. In the wake of a storm of questions about WeWork’s finances, it emerged that Goldman Sachs, which had acquired an initial stake in the company in 2014, sold down its investment prior to the planned IPO, according to the Financial Times and other outlets. At the same time, WeWork chose Goldman and J.P. Morgan (another investor) as the sole bookrunners for the IPO – essentially the banks that “sell” the company to investors. However, many potential investors hearing how great WeWork was from these banks did not understand these circumstances.

“I no longer listen to what people say, I just watch what they do.”

When considering an investment, the first question investors should ask themselves is, what is the motivation of the person pitching the idea? All of this reminds us of one of the most basic tenets of investing: buyer beware.

Some private equity firms have too much money to put to work and are cutting corners as a result. Softbank’s CEO has said that when it came to WeWork’s CEO, Adam Neumann, “I shut my eyes to a lot of his negative aspects,” according to a report in the Wall Street Journal. With so much money flowing into the largest private equity and VC firms, we fear that funds are deploying capital just to deploy capital, “shutting their eyes” and relying on the greater fool theory mentioned above. This is a common phenomenon at the end of a cycle.

Investors need to guard against being “comfortable” with investing. In this environment, investors are acting a lot like gamblers at a casino. Casinos go to great lengths to make patrons comfortable, whether it is free drinks or spending thousands of dollars on ergonomic chairs. Casinos are so “nice” because they want you to be comfortable and do not want you thinking about the risk you are taking. The same can be said for flashy investments with over-the-top outlooks. Softbank’s CEO said in August that “WeWork is the next Alibaba” (with a current market cap of approximately $480 billion). In this over-heated market, everyone is trying to outdo each other. Indeed, according to Dani Fava at TD Ameritrade, the use of the phrase “super excited” on earnings calls has quadrupled in the last four years. Investors should never be comfortable – much less “super excited” – about an investment. Circumstances change, and there are always new questions to be answered.

* * *

“The WeWork example is clearly a case study of hubris and perhaps even abuse of process. But is it a sign of just one or two high-profile private investors losing price and value discipline, or of the whole market taking leave of its senses?”

We have used WeWork as a case study, but as Peter Lee makes the case in an excellent post-mortem in Euromoney, it is representative of investors chasing returns, not doing the work required, and ending up taking on more risk than they realize. The reality is that investors should not buy a company with massive debt, negative cash flow, corporate governance problems, and data integrity issues. However, far too often it is only when it craters – and after investors have left the proverbial drive through window – that they realize the risk they have taken.

Due Diligence Tip – “Digital Risk”

Over the years, we have talked a lot about the risk of cyber attacks. We believe this is a risk that continues to be grossly underestimated. Five years ago, in late 2014, we highlighted in this space the fact that the SEC viewed cybercrime as one of the top threats to the stability of the financial markets. Yet many people do not realize that cyber risk is more than just protecting your identity and making sure your assets are secure. Investors need to understand the impact cyber risk can have on stock prices. In a CompariTech study last year of 28 companies that suffered major attacks, the authors concluded, "In the long term, breached companies underperformed the market.” We are constantly pushing our hedge fund and private equity managers to go beyond thinking about cyber as solely an operational concern. Cyber attacks directly impair enterprise value, and managers need to apply the same diligence and rigor used to protect their own franchise to the companies in which they invest.

One particular area of concern is the growing use of “deepfakes.” Deepfakes are yet another facet of the broader “digital risk” category, which includes data protection and cyber security. The term comes from combining “deep learning” and “fake.” It refers to the swapping out of one person’s face in a video with someone else’s using artificial intelligence and state of the art graphics. Examples include Mark Zuckerberg bragging about how his company "owns" its users. Another alleged deepfake portrayed the President of Gabon delivering an odd New Year’s address. One week later, Gabon’s military attempted a coup, citing the video as proof something was amiss with the leader.

We are worried about investment risks associated with deepfakes. Among other things, a bad actor could short a company and then circulate a deceptive deepfake video – for instance, of the CEO saying something negative about the company’s prospects with such verisimilitude that no one would know it was not real until after the stock plummets. As noted above, the nefarious applications of deepfakes go far beyond market manipulation to include affecting the outcome of elections and even terrorism.

We will continue to pound the drum on these issues – and share with our readers particularly insightful commentary on the subject when we come across it. In this quarter, our partner and colleague, Hank Crumpton, the 24-year veteran of the CIA and CEO of Crumpton Group, published an opinion piece in the Financial Times entitled, “Companies must start taking cyber risk seriously,” (READ ARTICLE HERE). We recommend reading it and sharing it with others.

* * *

Market Observations

According to the Bank of America Merrill Lynch’s Global Fund Manager Survey issued in August, the biggest “tail risk” fund managers are worried about is a trade war with China. Indeed, over 50% of respondents singled it out, above concerns about a bond market bubble or ineffective monetary policies. Certainly our relations with China get a lot of attention (often in Tweets by our President), but less reported concerns are equally troubling, if not more so:

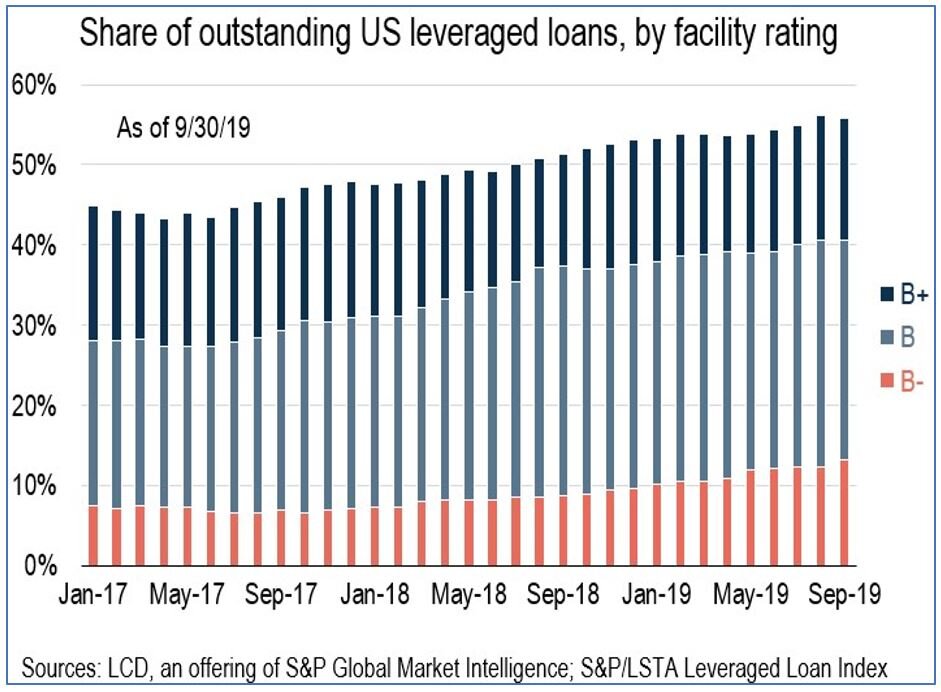

Leveraged Loan Markets Robert Frost once quipped, “A banker is someone who sells you an umbrella when it’s sunny and then asks for it back when it’s raining.” From what we see in the leveraged loan markets, there is no shortage of bankers selling umbrellas.:

We view this trend as more evidence of investors searching for yield in a low interest rate environment. Reinforcing this point, ZeroHedge reported in October that the average leverage for BBB-rated companies has increased from 2.0x to 3.2x in the past eight years. According to research from Morgan Stanley, more than half of all BBB debt would have a junk rating based on leverage alone. (We ask ourselves, what are the rating agencies thinking?) We are particularly concerned about the lending practices of companies owned by private equity funds. According to a report in the Wall Street Journal, about 57% of companies purchased in leveraged buyouts now carry debt loads more than six times their EBITDA. That exceeds the 51% ratio in 2007 on the eve of the financial crisis, according to Morgan Stanley data.

Wealth Inequality and the Overburdened Consumer. Deutsche Bank’s chief economist, Torsten Slok, published his top 20 risks for 2020 in November, and number one is the continued widening of the gap in wealth, income, and access to healthcare. Slok told MarketWatch that “a continued rise in inequality and the associated political response is something investors can no longer ignore.” The second part of that – the political response – has been on full display throughout the Democratic debates over the last few months. It is no surprise that the candidates are focusing on this issue. The cost of health insurance for a family recently reached a new record of $20,000, according to a Bloomberg report in September. As lawmakers struggle to find solutions, it seems inevitable that higher taxes and more expensive healthcare will be a significant headwind for the economy and equity markets.

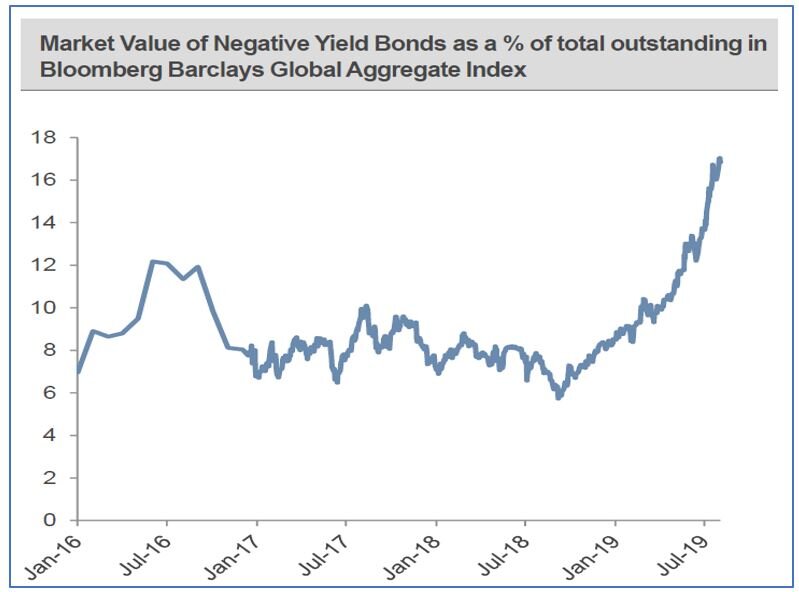

Negative Interest Rates. We always read Howard Marks’s commentary closely, and in his most recent letter he spends time on the rapid rise of negative yielding bonds, especially in Europe and Japan, as illustrated in the chart below:

Rational investors buy negative-yielding bonds (guaranteeing a loss at maturity) because rates may still decline further (becoming even more negative). In addition, deflation may cause your investment to rise in real terms or the currency of the bond may appreciate by a rate greater than the negative interest rate. Regardless, lending money at negative interest is a strange thing to get your head around. Indeed, among the counterintuitive effects of negative interest rates is that it encourages buyers of goods to pay for them sooner rather than later, because holding on to money longer does them no good. Similarly, companies have less incentive to collect receivables quickly because a dollar now is less valuable than a dollar in the future. Howard Marks noted that the pessimistic signals this sends may “have a contractionary rather than a stimulative effect” on economies. This is uncharted territory in many respects.

* * *

Organizational Updates

The news of the closure of Louis Bacon’s hedge fund brought about more talk of “the death of hedge funds,” something we have written about many times over the years. There is certainly evidence that demand for hedge funds continues to decline. According to Institutional Investor, investors redeemed about $41 billion from long-short equity funds on a net basis during the first ten months of 2019, almost quadrupling net outflows seen in all of 2018, according to eVestment data. However, as long-term investors, we are in the minority in continuing to increase our resources to conduct diligence on our current managers and on the small number of new managers we consider adding to our entities each year. When we reflect back over our 20+ year history, we see a clear trend of increasing the number of investment professionals in our firm while at the same time decreasing the number of managers with which we partner. At our current level of 18 hedge fund manager relationships, we have a team of 13 investment and finance professionals, the highest coverage ratio since inception.

In that regard, we are pleased to announce that Michael Benedetto has joined our firm as a partner on our investment team. Prior to joining the firm, Michael spent twelve years as a Managing Director at Southpaw Asset Management LP, a credit focused hedge fund. From 1997 to 2007, Michael was a Partner at Benedetto, Gartland & Company, a boutique investment bank and private equity placement agent. Previously, Mr. Benedetto was with the Mergers and Acquisitions group at Merrill Lynch & Co. and the Corporate Finance department at Salomon Brothers Inc. Michael received a B.A. from Georgetown University and an M.B.A. from the Wharton School of the University of Pennsylvania. We feel that with Michael’s background in investment banking in private equity and at a credit fund, he will be a strong addition to our due diligence resources.

We welcome any questions or thoughts you may have.