AIM13 Commentary - 2022 Q4

“There are decades where nothing happens;

and there are weeks where decades happen.”

We chose the quote above for this letter a month ago, yet the events of the last few days in the banking sector now make it seem particularly relevant. Rather than re-write this letter to fold in one of the biggest developments in the markets since 2008, we have included a short appendix with our thoughts on the subject along with this letter.

As this banking crisis reminds us, we live in a time of great uncertainty. Any given day can bring something that is unexpected (and frightening) and that could change markets and the world in ways unimaginable. Whether it comes in the form of a bank failure or some other financial crisis, or it is Russia, terrorism, China, cyber, Iran, North Korea, bio-warfare, infrastructure attacks – you name it – we think the threat landscape for investors has not been worse in recent memory. With so much risk out there, combined as discussed more below with a market environment favorable to hedge funds, we believe that now is not the time to abandon “hedgeD” investing.

Yet hedge funds are once again under a spotlight of criticism, despite outperforming the broader indices in 2022 by as much as 600 basis points (comparing the HFR investable equity fund index and the S&P 500 Total Return (“S&P 500 TR”)). Articles with titles like “The Nonsensical Growth of Hedge Funds” and “No Hedge Funds, No Cry” speak to people’s skepticism of the strategy. However, although many hedge funds could (and should) fail, we continue to believe that investors should include hedge funds as a part of an overall portfolio.

* * *

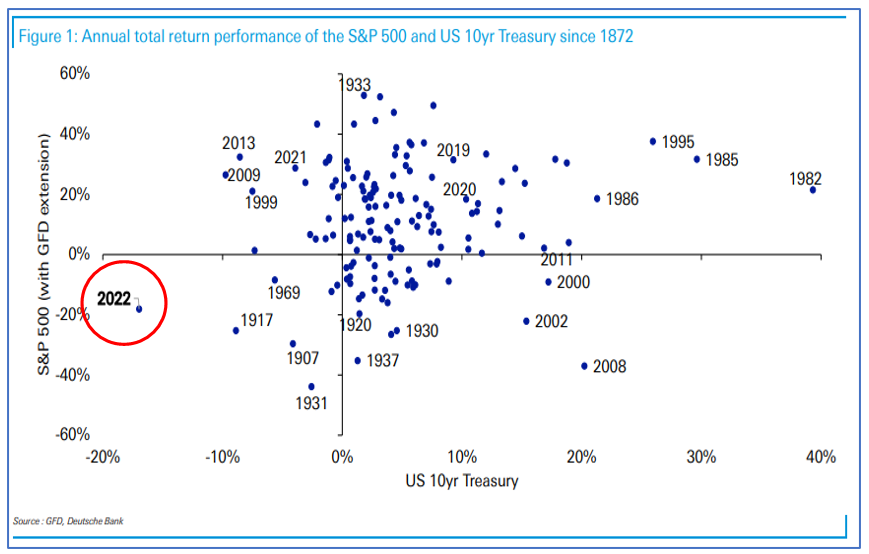

According to Deutsche Bank, for the first time since the beginning of recorded annual stock performance in 1872, both the 10-year Treasury (-17.0%) and the S&500 TR (-18.11%) lost more than 10% for a full calendar year in 2022. Only cash generated positive returns during the year, with the typical 60-40 equity/bond portfolio posting its worst performance since the 1930’s.

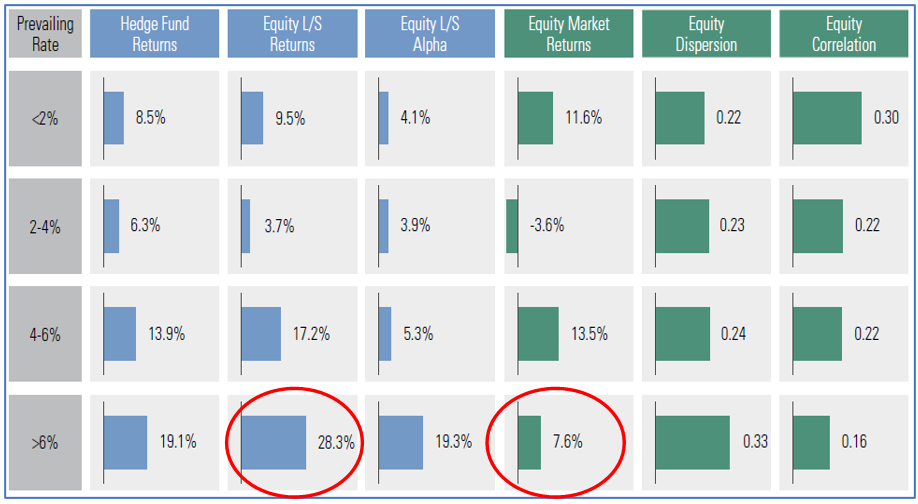

The markets had a strong start in 2023, with the S&P 500 TR rising about 9% year-to-date through February 2nd in what some call a “junk rally” – only to give back almost all of that gain since then (as of March 13th). Peloton, a stock that more than doubled in the first 30 days, has lost about half of that gain since then. The roller coaster ride this year is symptomatic of a market that is feeling its way through uncertain territory – primarily driven by rising rates and high inflation, two dynamics that historically have been favorable for hedge funds:

Interest Rate Environments and Hedge Fund Returns

Source: Goldman Sachs as of 12/31/2022, based on data from SPDJI, Goldman Sachs Marquee Connect, investor letters provided to the Goldman Sachs Capital Introduction team, and HFR. Prevailing rate refers to 3-month ICE LIBOR annualized rate; equity returns refers to MSCI World TR; equity dispersion and correlation refer to S&P 500 realized intrastock correlation & dispersion; equity L/S alpha calculated on an equally-weighted basis using Jensen’s alpha methodology: Equity L/S returns minus beta-adjusted equity index returns minus risk free rate. Calculations are based on prevailing rate by month and then annualized.

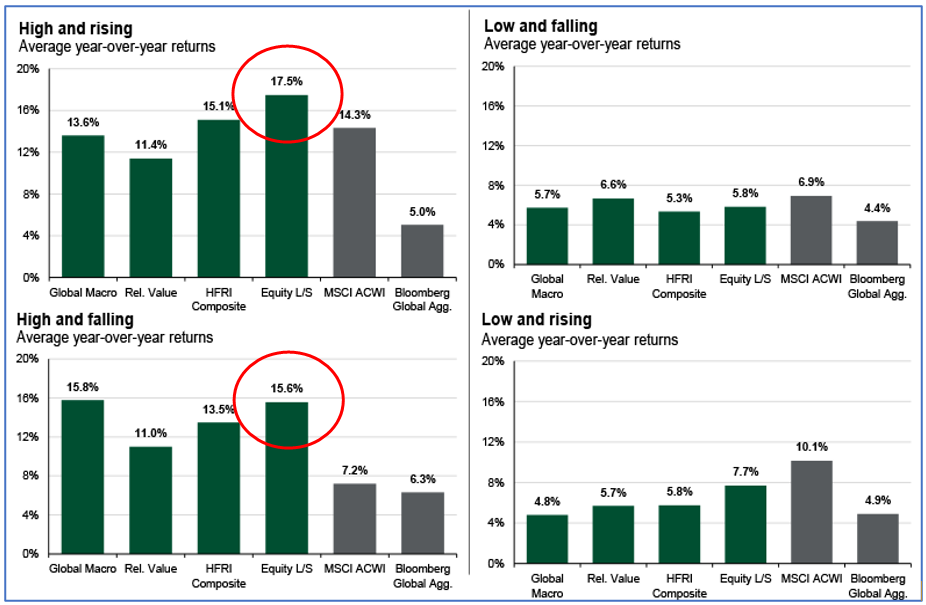

Inflationary Environments and Hedge Fund Returns

Source: JP Morgan as 11/30/2022 based on data from FactSet, HFRI, U.S. Department of Labor, and J.P. Morgan Asset Management. All hedge fund returns are from HFRI Composite Index. “High” inflation is defined as any year-over-year headline CPI reading above the historical median, while “low” inflation is defined as any y/y headline CPI reading below the historical median. The historical median y/y headline CPI for the period 1991 through October 2022 is 2.46%.

The minutes of the Federal Reserve’s meeting at the end of January indicated that “upside risks to the inflation outlook remained a key factor shaping the policy outlook.” Accordingly, interest rates will need to move higher and stay elevated “until inflation is clearly on a path to 2%,” according to a Reuters report on the meeting in early February. In other words, higher rates and high inflation are not going away anytime soon. Against a backdrop of a slew of geopolitical and market risks noted above, we believe a strategy that historically performs well in environments like this and provides downside protection will reward long term investors. In short, this is a time when experienced managers who know how to short have opportunities to outperform the market.

* * *

Decision Making in the Information Age

One of the greatest challenges facing investors today is finding the right information to make good decisions. Every day we fight against the so-called “echo chamber effect” and listen to almost anything. As we have said before, we all have two ears and one mouth, and we should use each in that proportion. We also believe that our structure, with access to diverse sources of information, gives us a unique perspective to see what others do not. That structure combined with our decades of experience helps us manage what we think are the most common impediments to good decision-making:

Read Widely and Diversely. We thought about the importance of being open to obscure sources of information as we followed the fiasco of George Santos’s recent election. Months before the bombshell New York Times story about the congressman’s finances and well before the election, a small paper on Long Island raised serious questions about the legitimacy of his net worth claims. Had the information been widely disseminated, voters likely would not have voted him into office. The fact is the information was out there but people just missed it. If you only read The Wall Street Journal/New York Times/[insert your favorite news source] etc., we guarantee you will not get a complete story.

Ignore Narratives. We recently attended a session about the college application process, and one theme was about “creating a narrative.” The idea is that applicants need to conjure up a “story” that is compelling and makes them stand out. The problem is that sometimes people back-fill their lives with things that support (or even create) only the “story” that they want to project – and it is not necessarily who they are. Our job, as investors and parents, is to focus on actions not narratives. Unfortunately, people often accept stories without a critical eye. After his fraud was exposed, George Santos told Piers Morgan that he did not think people would find out the truth because he said, “I ran in 2020 for the same exact seat for Congress and I got away with it then.” Too many people – from students to investment managers – “get away” with fooling people into believing a story and not seeing the truth.

Recognize Biases. Bias in sources is probably the most common impediment to good investment decision-making. When an analyst pitches an idea to a portfolio manager, he or she is motivated to get the idea into the book – and therefore stresses (either consciously or unconsciously) the good things and de-emphasizes the bad. After all, an analyst never gets a bonus on an idea that was pitched and passed over. The challenge is identifying the bias, stripping it out and seeing what is left – either a good idea or a bad one.

Avoid Emotions. Emotions regularly interfere with rational decision-making, and even the best investors struggle to maintain the discipline required to make unemotional decisions. In a portfolio review, we once asked one of the greatest hedge fund investors of all time what price he had paid for a particular stock, and he answered that he did not know and frankly did not care. All that mattered was where it was going from the current price.

Put Reliability and Integrity Above All Else. Ultimately, a good decision must be based on information that is true and accurate, and that can only come from trusted sources. For that reason, we constantly curate where we get our information, triangulating it from diverse sources by using multiple reference checks. In this regard, we believe the “trusted network” that is so cliché is the most important asset we have. After all, as we have said many times, past performance is not indicative of future returns, unless you are talking about someone’s character.

At AIM13, at our core we have always been and always will be a family office. Internal capital represents one of the largest investors across our strategies. Our structure provides us a tremendous advantage of being able to look across a portfolio of investments that spans cash, equities, and debt, invested through third party managers and in direct opportunities. While our outside partners invest alongside us primarily in private equity, direct deals, and hedge funds, our team members are generalists across asset classes, sectors, and strategies. We purposefully do not dedicate an analyst to, for instance, just healthcare or hedge funds. Rather, we want everyone to be fluent across the investment spectrum since we think the benefits of diverse inputs makes all of us better investors. As noted above, experience also plays an important role: across the six partners at our firm, the average tenure of professional experience is about 27 years – and we have the gray hairs to prove it.

Every day, all of us make small decisions and take actions that shape our character and determine whether we achieve our goals in life. When it comes to making investment decisions, for us those small steps represent our investment process – and why we think following a process is critical to making good decisions. While we strive to find and act on the best information possible, we recognize that we will not always be right. We often point out the Ted Williams “only” batted .406 in 1941, the best batting average ever. Now players who bat in the 300’s go to the Hall of Fame. No one is perfect, and for that reason we focus more on what we might be missing and what could go wrong and never rest on what we have done in the past.

Market Observations

As we alluded to above, treasuries posted their biggest annual loss ever in 2022, fueled by the Fed’s fight against inflation in the form of overnight rates that surged more than four percentage points. With a weak equity market, this chart illustrates just how badly an equity-bond portfolio performed in a historical context:

Source: Deutsche Bank

In the midst of one of the most challenging market environments in recent memory, a few less-reported developments suggest to us that we are far from out of the woods – and indeed things could get a lot worse:

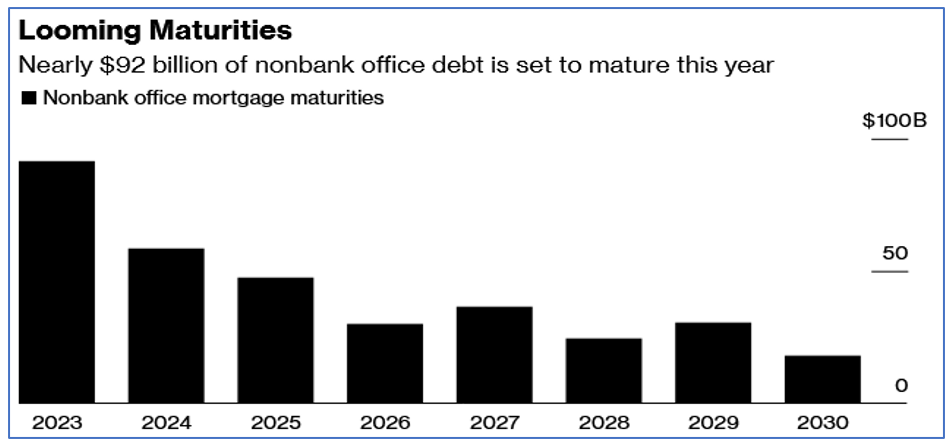

Office Landlord Defaults. More evidence is emerging that the shift to remote and hybrid work is having a profound effect on office properties. Combined with rising rates, which commercial landlords are vulnerable to given the prevalence of floating rate debt, office landlords are edging “closer to a tricky edge” according to a Bloomberg report in early March. Brookfield Asset Management recently defaulted on $750 million in debt for two 52-story towers in Los Angeles, according to a February securities filing, and a PIMCO office landlord defaulted on $1.7B of debt in February. New York City is particularly vulnerable. According to report published in February by Metro Manhattan Commercial Office Space, these Park Avenue properties face a particularly uncertain future:

RFR Holding’s Seagram Building at 375 Park Ave. is just 75% occupied and has a $783M loan maturing in May.

Tishman Speyer’s Colgate-Palmolive Building at 300 Park Ave. is barely 80% occupied and has a $485M loan maturing in August.

The Stahl Organization’s $750M loan for 277 Park Ave. matures in August 2024. However, it must confront the loss of its anchor tenant JPMorgan Chase as it prepares to move into its own building across the street.

These examples are just a few of the nonbank office loans that are due to mature in the near future:

Source: Bloomberg, Mortgage Bankers Association

“It’s going to be a very tough two years until the market finds an equilibrium,” Ran Eliasaf, from Northwind Group told Bloomberg on March 1st. “In the meantime, there’s going to be a lot of hurt and unfortunately, a lot of money lost.”

Blackstone Suspends Redemptions. A somewhat related dynamic is playing out in funds that hold private assets yet offer investors public equity-like liquidity. Many of these funds are public REITS that hold illiquid real estate assets while offering the ability for investors to periodically redeem at net asset value (NAV). Others are private equity funds structured as “evergreen” investments. The problem is that the underlying asset pricing often lags, and when NAVs steeply drop, investors rush to the exit at the same time. In December, Blackstone’s $69B REIT was forced to limit withdrawals after a surge of redemption requests. Starwood and KKR also recently hit their redemption caps. There is likely to be more trouble ahead in the coming year as the private sector continues to lower NAV’s to reflect evolving market conditions.

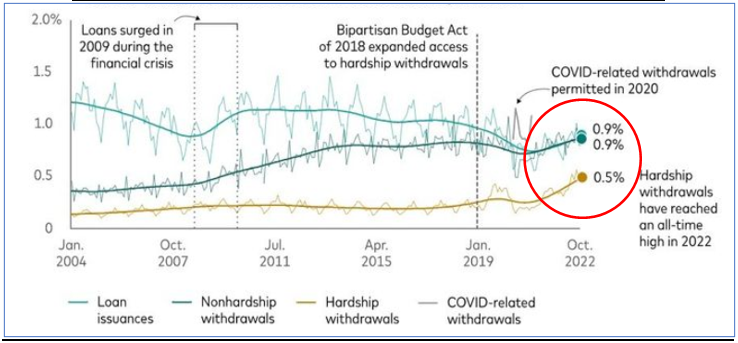

401(k)’s Under Pressure. According to a February 27th report on Marketplace, Fidelity reported that the average 401(k) account lost 21% of its value last year, and the average IRA fell by 23%. Likewise there was uptick in loans and hardship withdrawals, according to Greg McBride, a financial analyst at Bankrate.com. Vanguard recently published the chart below showing how hardship withdrawals in fact reached an all-time high in 2022:

Share of 401(k) Participants with a Loan or Withdrawal in Given Month

Source: Vanguard

The issue we see here is that many consumers view their 401(k) as an indicator of their ability to spend freely on expensive items. Not surprisingly, the Consumer Confidence Index fell in February for the second straight month. A related “expectations index,” also published by the Conference Board, which measures consumers’ six-month outlook for income, business and labor conditions, dropped to 69.7 in February from 76 in January. A reading under 80 often signals a recession in the coming year, the Conference Board said in a report on MoneyWatch. Seeing this data, Chris Rupkey chief economist at FwdBonds commented to CNN Business recently, “If consumers drive the economy, the outlook for 2023 is bleak, as the consumers expect that the worst is yet to come.”

Cyber Tip

Hackers are increasingly turning to phishing texts that prey on the spontaneous and sometimes less-than-thoughtful reactions we all have when reading a text on the go. A common ploy is for hackers to pose as FedEx or the U.S. Postal Service with a link purportedly associated with a package or delivery we might legitimately be expecting. We all saw these spike during the holiday season when deliveries are at a seasonal high. One recent scam several of us have encountered recently is an account-locked notification which appears as a text that looks like it is coming from Amazon notifying a subscriber that their account has been locked. Clicking on the link provides the hacker with access to your smart phone – and everything saved in it.

* * *

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13)