AIM13 Commentary - 2022 Q1

“It’s such a fine line between stupid, and uh… clever.”

We have been talking about the risk of sustained underperformance in stocks for over a decade and that a hedged program only demonstrates its full value to the portfolio in that environment. Some might say we have been stupid or at best wrong. Of course, with certain exceptions (notably the pandemic pullback in February-March 2020), a case can be made that hedge funds have not recently added value to a portfolio. However, does being “wrong” for an extended time mean we should give up on hedged investing for this portion of our portfolio? Or will we eventually be proven “right”? For the reasons we explain more fully below, as the disclaimers on investment performance always tell us, past performance – in this case, an extended bull market run – is not necessarily indicative of future returns.

In our quarterly letters, we do not typically comment on performance following the end of the quarter, however recent market action merits an exception. In April, the S&P 500 TR dropped (8.72%), and as of the close on May 24th was down a further (3.56%) from there. The NASDAQ has had a dizzying drop, down (13.26%) in April and another (7.30%) since then. April was an extremely difficult environment. In the post-Global Financial Crisis period since January 2010, April 2022 ranks as the third worst for the broader market:

The returns needed to get back to even in sharply falling markets demonstrate the importance of downside protection. Investors often lose sight of the “power of negative numbers” and what it takes to recoup steep losses (which is why we include a slide showing it with every letter).

* * *

Source: Jon Adams, The New Yorker

“Opinions are like [a certain body part], everyone has one.”

Today there is no shortage of opinions – whether it is about COVID, politics, investing, or anything else. Since opinions have no cost, people are constantly spouting off about things with the certainty of fact. Inevitably, other people listen to it and take it as gospel truth. They ignore specialists with experience and knowledge in their fields, and assume they are right about everything. We wrote about this phenomenon in our 2020 second quarter letter, referring to the cognitive bias known as the Dunning-Kruger effect, which can be summed up as believing you are smarter than you are. Indeed, we think that many people have been very wrong about COVID, but their conviction never wavers. Unfortunately, in the age of a global pandemic, the “everyone is an expert” problem has only gotten worse.

In the markets, we see similar over-confidence in one’s own knowledge and ability to predict the future, even among experienced investors. Too many investors think they are smarter than everyone else. Not surprisingly, the people who profess to have all the answers about investing are also often the same people who have never had a losing investment (or so they tell us!). We remind ourselves every day that humility and understanding what you do not know and how things have evolved are the cornerstones of successful long-term investing. In fact, one of Ira Harris’s core philosophies was that no one gets everything right. He often observed that even in Ted Williams’s best year, he “only” batted .406, which means that almost 60% of his at bats he made an out.

“When speaking, successful people tend to use a lot more question marks than periods.”

We know that every decision we make will not be the right one in retrospect. However, we do believe that an entity consisting of several truly “hedged” managers provides protection for this portion of our overall portfolio. There are some people we respect who have given up on hedged fund investing. We feel strongly that in five or ten years, we will be compensated for staying focused on protecting the downside.

“Complacency is a sword of two edges. One edge kills hard earned successes while the other end stops future glories. Complacency is a murderer and a barrier!”

Complacency and the misplaced confidence in one’s own abilities are some of the greatest impediments to successful investing. In our view, partnering with smart, seasoned investors who have their own money invested alongside their partners is the best place to make superior risk-adjusted returns over the long term. Experience, patience, and alignment of interest are the three most important attributes of an investor with whom we want to partner.

“Speculation is the most dangerous when it looks easiest.”

Investing is not – and should not be – easy. Unfortunately, there have been extended periods in the last decade where it seemed a “rising tide lifted all boats,” skewing investors’ perspectives of what a “normal” market is, with its cycles of up and down periods. We were speaking with one person in late April who argued that being invested in a long only S&P 500 TR index fund was a “safer” investment than hedge funds. That might be the case if one just looks back over the last thirteen years or so. To us, that is a bull market view. We have seen this a lot over the last four decades, people with a recency bias overestimating their ability and how they will behave when the market crashes.

“If you don’t know where you are going, you might wind up someplace else.”

Now is not the time to chase returns. We tend to find that the most vocal critics of hedge funds are the same people who put money into the market at the wrong times. Just sixteen months ago, following a strong year for hedge funds in 2020, investors were clamoring for more. They were convinced that hedge funds’ protection of capital during the pandemic pullback and participation in the market’s surge afterwards made them ideal to manage risk. Now after a difficult 15-month period, investors are (once again) negative on the strategy. However, what has really changed? We think this sort of fair weather friend-mentality is at odds with successful, long term investing.

“The good thing about being bearish is you are never wrong, just early.”

As we said at the beginning of this letter, we can be faulted for our negative views on the markets over time and our focus on the risks we see. At this moment, our sense of risk is as high as it has ever been. Most widely discussed are the risks associated with rising rates, which almost cannot be overstated. In late March, the 2-year and 10-year Treasury yields inverted for the first time since 2019, a signal many believe portends a recession.

We are not alone in having serious concerns about the markets. In early March, in a Bloomberg report entitled, “Stock Market Bottom Slipping Away After 13 Years of Dip-Buying,” Sarah Hunt, a portfolio manager at Alpine Woods, said, “After a long period of no volatility, we’ve got so much volatility. It’s a very different environment than we’ve been in for the last several years.” Indeed, the average bull-bear spread, a common indicator of sentiment among market forecasters, recently reached a multi-decade low – and this was before the most recent pullback. Even among consumers, the outlook for the coming year has reached lows not seen since the Great Financial Crisis, according to the University of Michigan’s consumer survey:

Source: University of Michigan (2022)

Beyond our concerns about the markets, we see heightened risks associated with things going on in the world today that we have written about in the past:

Cyber Attacks. According to a new intelligence report from Microsoft issued at the end of April, there have been more than 230 distinct cyber operations in Ukraine from at least six Russian threat groups since the war began in February. As a result of the war, the cyber threat environment both “within and beyond the region” has become so acute that the so-called “Five Eyes Nations” (the U.S., United Kingdom, Canada, Australia, and New Zealand) released a joint Cybersecurity Advisory warning of the risks of potential cyberattacks. We have often used these pages to remind readers of the importance of cyber security and we must never lose sight of the risk of a major cyber event – one that could disable markets, cause untold financial or personal harm, or much worse. Vigilance and taking steps to protect oneself are required now more than ever.

Terrorism. The horrible shooting in Buffalo, New York recently represents another terrible chapter in what seems to be a growing trend of racially motivated and extremist-inspired domestic terrorism. We share the outrage and pain of the victims’ families and friends, and call upon lawmakers to do more to stem the tide of such attacks. Equally we should not lose sight of the risk of foreign, lone-wolf terrorism on our soil or abroad. The fall of Afghanistan has fueled concerns that “the country may again become a hub of instability and terrorism across South and Central Asia and beyond,” according to a recent report in Foreign Policy. Violence is intensifying eight months after our retreat allowed the Taliban to return to power. Awareness of the risks – and preparations for an attack – remain critical.

The Opioid Crisis and a Porous Southern Border. According to a recent report on Politico citing CDC data, more than 107,000 Americans died from drug overdoses in 2021, a new fatality record for the United States. The country remains in the throes of a decades-long opioid epidemic, with Black, Native American, and Hispanic communities – the most disenfranchised during the pandemic – as the hardest hit in the latest wave. The rise in drug deaths can be traced in part to illicit drug flows into the U.S. from Mexico. In March, migrant arrivals at our southern border soared to 22-year high, according to a report on ABC News. “The leading cause of death among Americans aged 18-45 is now fentanyl, 95% of which comes into our country across the southern border,” said Mark Morgan, Heritage visiting fellow and former acting commissioner of Customs and Border Protection, as reported on TheCenterSquare.com.

In this environment, with so much risk on the horizon, we must also fathom the unfathomable. We were reminded of this recently when someone mentioned to us watching The Living Daylights (1985), where James Bond must foil an evil plot to destroy Silicon Valley – solely to create a chip shortage and ensure a monopoly on the production of computer chips. That was pretty far-fetched thirty-five years ago, but now not so unimaginable as China’s chip production surges past ours, our dependency on Chinese chips reaches dangerous levels, and China stands poised to potentially invade Taiwan (one of the largest chip producers in the world). When we think about the unthinkable, just six months ago, who would have thought that “nuclear war” would be trending on Twitter, as it was on March 2? In a time of great uncertainty and rapidly emerging threats –– we must widen our scope of what is possible.

Market Observations

Rising rates threaten companies acquired in the recent LBO boom. For the last several years, low-rated companies borrowed unprecedented amounts of capital with floating-rate debt to take advantage of low rates and generous credit underwriting. According to a report in late April in the Wall Street Journal, U.S. companies borrowed a record $1.8 trillion in junk-rated loans in 2021, based on data from Dealogic. As interest rates rise, however, interest expenses on these loans are also rising. Companies with heavier debt loads can find themselves running short on cash if their interest rates climb alongside wages and other operating expenses – which are also rising with inflation. Referring to this risk, Somnath Mukherjee, head of investments at Lakemore Partners, told the Journal “It is one of the biggest concerns that we have and we have been tracking it in our portfolios since the end of last year.” The chart below illustrates how companies’ cash flow coverage – which improved since the onset of the pandemic – has deteriorated recently, largely driven by higher rates on debt and increased commodity prices:

Source: Bank of America

Can the world feed itself? In early May, we attended an investment conference focused on the national security space, and one of the biggest concerns among the speakers was the current strains on the global food supply chain. Constraints on virtually every input into farming combined with diminishing supplies in the wake of the war in Ukraine create the real possibility of a global food shortage. One of the most important drivers of food prices is the price of fertilizer, which has seen a six-fold increase in the last two years:

Surging Fertilizer Prices

Source: Bloomberg, as reported by Doomberg.com, March 26, 2022

“Corn is the most fertilizer-intensive crop and is likely to be the most impacted by rising input costs driven by the spike in fertilizer prices,” Jeremy Thurm of Aegon Asset Management told Barron’s recently. Supply constraints are also a problem. About 25 million tons of various grains are sitting in storage silos in port cities such as Odesa, unable to leave Ukraine because of an ongoing Russian blockade in the Black Sea, according to a recent Fortune report. On May 12th, the United Nations sounded the alarm: “In 2023, you will have a food shortage problem,” said David Beasley, executive director of the UN’s World Food Programme. A day after that warning, India announced that it was instituting a wheat export ban. The crisis has already caused riots, with crackdowns on protests leading to five deaths in Iran, according to reports from the Iran Human Rights Monitor.

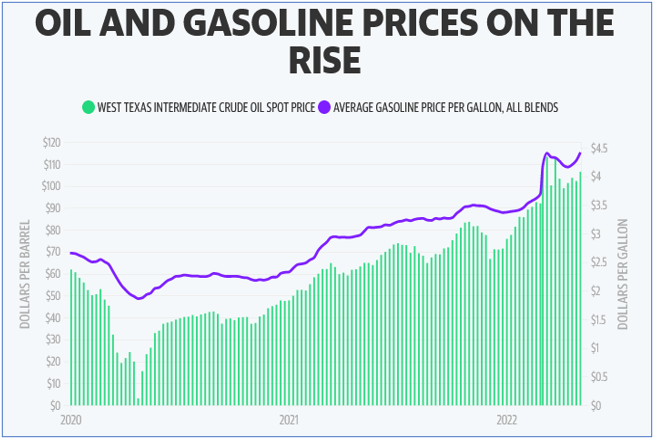

Throwing fuel on the fire: Spiking crude oil prices worsen recessionary prospects. Crude oil prices spiked in late February and early March with the Ukraine war. After retreating for several weeks, oil has surged recently, with gas prices hitting record highs in mid-May:

Source: U.S. Energy Information Administration, Yahoo Weekly

“With a planned ban by the EU on Russian oil and slow increase in OPEC output, oil prices are expected to stay close to the current levels near $110 a barrel," said Naohiro Niimura, a partner at Market Risk Advisory, as reported in Business Standard. Energy prices are one of the biggest determinants of inflation and ultimately the overall performance of the economy. On the heels of gas prices at record highs, Lloyd Blankfein, Goldman’s former CEO told Face the Nation on May 15th that a recession is a “very, very high risk factor” right now.

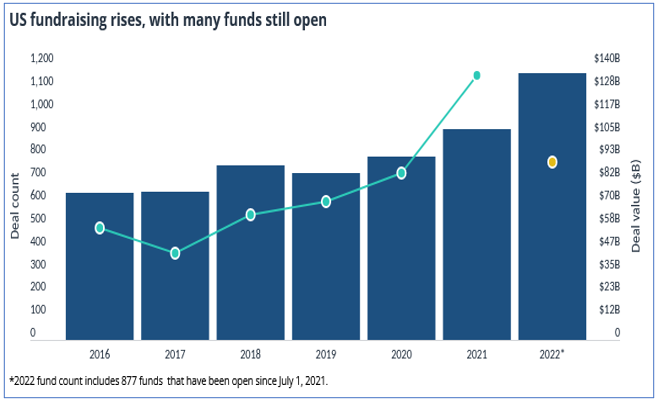

The Flood of Venture Capital. According to Pitchbook, venture capital funds in the U.S. have already closed on more than $90 billion through May 4, 2022. In just a little over four months, about two-thirds of 2021's total has been raised. Assuming that pace continues, 2022 will be the most active fundraising for VC funds in history:

Source: Pitchbook; bars represent the fund count, line represents deal value (capital raised), yellow dot is the current amount raised in 2022 as of May 5, 2022.

Meanwhile, in a classic late-stage phenomenon, as venture capital fundraising reaches record highs, performance of venture-backed IPO’s has plummeted:

Source: Pitchbook

* * *

We welcome any questions or thoughts you may have.

Sincerely,

Alternative Investment Management, LLC (AIM13)

[i] The S&P 500 TR Index (the "S&P 500") is a well-known stock market index which contains a representative sample of leading companies in leading industries. The criteria for inclusion among the companies comprising the S&P 500 do not include accelerated sales or ostensible barriers to entry. The S&P 500's rate of return reflects its percentage change for each period and provides investors with a price-plus-gross cash dividend return but does not reflect the deduction of any expenses or fees. The historical values of the S&P 500 TR match the historical values of the Barra S&P 500 (which was the previous Standard and Poor’s 500 Index).