AIM13 Commentary - 2025 Q2

“Hey, Bud, let’s party!”

A few weeks ago as we were carrying boxes up dorm stairs and trying not to embarrass our child with too many goodbyes, one image stuck with us: the “darties.” For those who have not spent time on a college campus recently, darties are daytime parties. Picture music on the lawn, red cups, beer pong – and everyone convinced they have discovered a formula for endless joy. It is fun to watch. But as parents, we know something many students will only learn the hard way: every party eventually ends, and the hangover is real.

We have a similar view on today’s markets. Stocks and home prices sit at record highs. Interest rates are poised to drift lower. Inflation, once a household worry, is largely contained. Unemployment remains low. Many indicators seem to be flashing green. For many, it feels like a “can’t-miss” party, and everyone is worried about FOMO. That is exactly when we worry most. Over the decades, we have seen that markets rarely falter when fear is widespread. When investors are cautious, risks are priced in, and valuations reflect anxiety. Setbacks are absorbed with resilience. Trouble arrives in periods of unguarded optimism. The real danger lies not in panic, but in complacency — when investors stop asking questions because everything appears too easy.

We have used the metaphor of partying too much and facing an impending hangover because we believe the “partying” that is going on in the markets belies some very troubling things not too far below the surface. For instance, consider the following:

As of late June, while the S&P 500 sat at all-time highs, only 22 of its constituent stocks were at their all-time highs, according to Bank of America research. Not only is this an indicator of overvaluation, but also of the limited breadth of the market rally.

As of early August, Nvidia and Microsoft alone accounted for almost half of S&P 500 returns this year, as reported by Investing.com. To put this in perspective, according to a post on Zerohedge, Nvidia is larger than each of the Staples, Energy, Utilities, REITs and Materials sectors (not combined).

According to post in August from Charlie Bilello, gold and Bitcoin are the top performing major assets so far in 2025, up +29% and +25% respectively. We have never seen these two in the top two spots for any calendar year. Indeed, gold bullion rose to a record high of near $3,540 an ounce on September 3rd.

In our conversations with a lot of investors today, rarely do people talk about risks or such things as valuations, earnings, balance sheets, or debt levels. Instead, investors only ask about performance. Which funds are oversubscribed? What sector is “hot”? How much did the S&P 500 gain this quarter? In this way, the good results in the markets have crowded out critical thinking. The discipline of analyzing risk has been replaced by a backward glance at recent returns.

We are old enough to remember that in the late 1990s, technology stocks surged on the belief that a new economy had rendered old valuation metrics obsolete. Companies with no earnings traded at stratospheric levels because everyone else was buying them. The party ended abruptly in March 2000, leaving investors to sweep up the remains of their portfolios.

A few years later, in the mid-2000s, real estate became the “darty” of choice. Rising home prices convinced both homeowners and institutions that risk had vanished. Complex mortgage securities were packaged, sold, and rated as safe, not because they were, but because optimism drowned out skepticism. That party ended in 2008, and the hangover was global.

This is not to say that optimism and indeed risk are inherently bad. Without either, no one would invest in new businesses, build new technologies, or drive progress. However, optimism becomes dangerous when it blinds us to risk. When prices embed perfection, there is no margin for error. A single disappointment — a missed earnings report, a policy shift, a geopolitical event — can be enough to puncture the mood.

The reason we emphasize the hangover is not to dampen anyone’s fun. It is to remind ourselves — and our partners — that investment success is not about avoiding every setback, but about surviving them. Parties end. Corrections come. What matters is not whether they arrive, but whether we are prepared. Preparation, in our world, means resisting the crowd when it feels most comfortable and, most importantly, remaining hedged. It means asking not just “what did it return?” but “what risks are embedded in those returns?” Unfortunately, we think not enough investors are asking the right questions right now.

Market Observations

“Risk is what’s left over after you think you’ve thought of everything.”

Beyond what we see are risks in the equity markets, some other things that keep us up at night include:

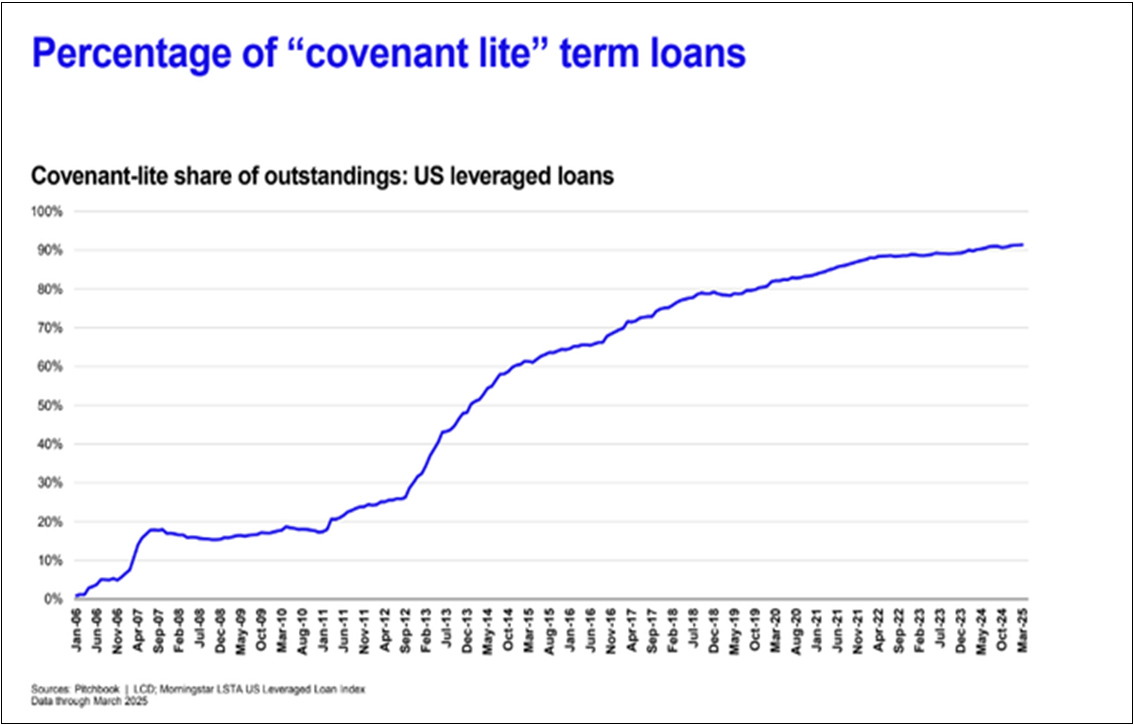

Expansion of Covenant-Lite Loans. Covenant-lite loans have significant risks because they strip away many of the traditional protections lenders typically negotiate. Unlike standard leveraged loans, cov-lite loans relax or remove maintenance covenants that require borrowers to meet ongoing financial tests, such as debt-to-EBITDA ratios. This means lenders have fewer warning signs and less control when a borrower’s financial health begins to deteriorate. While the looser terms make it easier for companies to raise debt, they can mask underlying weaknesses and increase losses in a downturn, as problems may only surface when it’s too late to intervene. For investors, cov-lite loans can offer higher yields in good times, but they magnify credit risk when markets tighten or defaults rise.

Source: Pitchbook, Morningstar

Artificial Intelligence: Risks and Opportunities. An investor we respect said to us recently that if it were not for the spending on AI, we would be in a recession. While we see enormous opportunities associated with AI discussed below, an AI bubble in the markets poses serious risks because valuations can become disconnected from the underlying fundamentals of companies. Reminiscent of the dotcom and real estate booms/busts mentioned above, investor enthusiasm and speculative capital are rushing into anything branded as “AI,” driving stock prices sharply higher even when business models are unproven or revenues are minimal. If earnings growth fails to justify lofty expectations, confidence can unravel quickly, triggering sharp corrections across the sector. An AI bubble could also distort capital allocation, funneling resources away from sustainable businesses into hype-driven ventures. For broader markets, the risk is contagion. When overvalued AI stocks deflate, it can drag down indexes, damage investor sentiment, and reduce liquidity across asset classes.

Beyond the enormous money being spent, another thing that worries us about AI is the dominant position ChatGPT enjoys relative to its peers:

Source: Deutsche Bank Research

Aside from being an indication of just how fast the surge in popularity of AI tools has been, it also suggests that we are still in the early innings of this industry’s development, with a lot of disruption ahead.

While we believe these risks associated with artificial intelligence are real, we also believe in the enormous opportunities that the new technology has created and will continue to create. The gains in productivity and efficiency will be a tailwind to the economy, and we at AIM13 are already seeing the benefits of AI tools. Beyond the obvious advantages of ChatGPT and its peers have over conventional internet research, we have implemented other AI solutions to improve our research process, save time and, we think, make ourselves better investors. We are also seeing exciting investment opportunities associated with AI around such things as datacenters, energy production (nuclear), cooling, and other areas that are the “picks and shovels” of the new technology – both in public and private companies.

Serious Cracks in Student Debt. TransUnion reported earlier this year that about 5.8 million borrowers, or roughly 31% with ongoing repayment obligation, are 90 days or more past due, marking the highest delinquency rate ever recorded. This is corroborated by New York Fed data that shows that in the second quarter 2025, about 10.2% of aggregate student loan balances were 90+ days delinquent, a significant surge from under 1% prior to the pandemic-related pause:

Source: New York Federal Reserve

While a part of this spike can be attributed to the sunsetting of various repayment forebearance programs following the pandemic, that dynamic itself is another example of something troubling that can be going on below the surface that is not immediately apparent. More than anything, that is what always keeps us up at night.

* * *

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13)