AIM13 Commentary - 2020 Q4

“Be careful when you follow the masses.

Sometimes the “m” is silent…”

We chose this letter’s quote in early December, well before any of the turmoil in January, since it embodies one of our core beliefs. There are many professional investors who operate with the philosophy that “you can be wrong, but not alone.” We believe, however, in independent thinking, and not being driven solely by what others are doing. We constantly remind ourselves that partnering with managers who have certain key characteristics will pay off over the long term. These characteristics include, at a minimum:

A demonstrated track record built on intelligence, hard work, AND NOT JUST LUCK.

The manager’s personal capital invested in the fund alongside investors who are true partners.

Terms of the partnership that are designed for long-term returns and align the interests of all partners.

A manager’s exemplary character – as an investor and as a person – that we can reference check.

We never deviate from these beliefs, regardless of what the “crowd” thinks, either in terms of the “hot” manager or the latest and greatest investment strategy. While we are aware of what other people think, what is most important is the independent work that we do.

While we work hard to maintain this discipline, we also guard against being stubborn or anchored to our own opinions. In that regard, we are constantly looking for opposing views to challenge our thesis or biases. Whether it be in politics, business, or everyday life, we believe that trying to understand all sides of an issue is critical for success.

“For I am not so enamored of my own opinions that I disregard what others may think of them.”

The growth of technology has created almost unlimited options to obtain “news” or investment advice. The chart below illustrates just how dramatically the Internet has emerged as one of the primary sources of information, especially with respect to investments:

Unfortunately, it is human nature to gravitate towards opinions that reinforce what one already thinks and equally to dismiss or discredit contradictory perspectives – and the Internet has made this very easy. We, however, strive to always question the bias of any source of news or “facts.” Moreover, while we remind people not to just follow the masses (remember, often the “m” can be silent), we also do not dismiss what others say or perceive since it is imperative to pay attention to opposing views in order to be aware of our own biases or any weaknesses in our conclusions.

We always strive to make decisions for the right reasons (generating long-term returns) and not for the wrong reasons (how it can be defended against criticism). In our experience, some of the best opportunities arise when a manager is going through a particularly challenging period. Indeed, on many occasions, we have made money adding to our underperformers and some of our best moves have been trimming our outperformers.

“Courage is grace under pressure.”

Mental discipline, and staying the course in this respect, can be enormously difficult. It is never easy to take emotion out of decisions, including frustrations about what may have just happened, and to be intellectually honest in any moment about a decision going forward. Too often, investors simply chase the highest performing managers or dwell on an investment that did not meet its objectives. We see the same thing in golf. A great golfer can hit a bad shot, and while they walk to their ball, they do not let emotion affect the next shot. In investment terms, the episode will not impact future performance. We are not great golfers, and when we hit a bad shot, we tend to think about it for at least the next five holes. In investing, we strive to be more disciplined and not let emotion dictate decisions when we analyze a development, good or bad.

We know we will experience difficult times but what matters most is how we deal with them. While we spend a lot of time and effort performing “after action” reviews on any situation that goes wrong (or, for that matter, right – more on that below), we also need to be able to step back and to remove from our decision-making any emotions that follow an event (either disappointment or exuberance). Successful investors learn from past mistakes, and they do not get emotional or panic.

The other key is being honest with oneself. The reality is that most people have a tendency to interpret facts to support their own views. Especially when things are going well, it is natural to suffer from overconfidence and to ascribe too much credit to one’s own role. After a good streak, whether in investing, sports, or even gambling, people will convince themselves how good they are. The reality, however, is that success is made up of luck, skill, and hard work. We can control hard work, and skill comes from hard work, but luck and circumstances also are components of success – and of failure. Unfortunately, many people confuse luck with skill.

Did anyone believe a year ago that stocks such as GameStop and others could increase as much as 1000%? The honest answer is no. Was this a lack of imagination? To answer that question, we think back to prior to January 6th, when no one could have imagined Congress being evacuated due to a storming of the Capitol. That experience reinforced the importance of always trying to imagine what one thinks is unimaginable. We have talked about the “unknown unknowns” before in our letters, and that is what we constantly challenge ourselves to identify. Through independent thinking and maintaining our “situational awareness,” we work hard every day to stay ahead of any future obstacles.

“The intelligent investor will need considerable will power to keep from following the crowd.”

When our dental hygienist told us in late January that she invested in Blackberry (a true story) or when Saturday Night Live is doing skits about GameStop, we realized this is more about gambling than it is about investing – which should be very boring! At times like these, risk management and keeping a long-term perspective are more important than ever. Having a process, discipline, and access to varying views allow one to calmly evaluate a situation and not get caught up in the mob mentality of the moment. We trust our process and although we constantly re-evaluate situations, above all we remain focused on the long-term.

We are constantly re-underwriting all of our managers (during good or difficult times) to challenge our original thesis about a manager and to ask ourselves, was it skill or luck that produced the outcome? We spend a lot of time looking at not only how a manager can avoid a mistake but also trying to identify what the next issue will be. Our due diligence process never stops evolving.

Due Diligence Tip: After-Action Reviews

As we have stressed before, one of the most important parts of our investment process is ongoing due diligence. A large part of this work is performing an after-action review where we rigorously challenge our prior decisions, regardless of whether they produced positive or negative results. This assessment involves how a manager has performed and what led to our decision, helping us to answer the question above: whether we were skilled or just lucky, or some combination of the two. Of course, it is much easier to replicate skill rather than luck.

Due diligence is often framed in terms of avoiding what can go wrong, and when things go right, the natural inclination is to repeat the same process the next time. Of course, it is imperative to learn from your mistakes and also from other people’s mistakes so we do not make the same ones others have. However, you also need to evaluate what happened even when things are going right. If not, nothing is gained from a successful investment outcome beyond reinforcing one’s processes, biases, and viewpoints. Even when something goes right, there is a learning opportunity. Could the outcome have been even better? Was something de-emphasized that should have been emphasized? Again, why did it go right? There are enormous insights and lessons that can be gained as much from good investments as from bad ones.

Market Observations

2020 was a remarkable year in many respects, as Goldman Sachs reported in early January with these data points on volatility:

In 2020, realized volatility was 35%. After 2008, this ranks as the second highest annual realized volatility since the 1930s.

The high-to-low trading range was 51% of the year’s midpoint, which ranks in the 92nd percentile and is also the second highest since the 1930s.

The peak-to-trough drawdown of 34% was the largest calendar year plunge since the 48% drop in 2008 ... and the year’s worst single-day decline (-12% on March 16th) registered as the worst since Black Monday in 1987.

Other developments that grabbed our eye relate to current stock valuations. For instance, the current valuation spread between Canada’s main stock market, the S&P TSX, and the S&P 500 is the largest in the last 20 years, according to research recently published on Seeking Alpha. Likewise, the number of stocks that soared in value is at a level not seen since the dot-com era twenty years ago:

Small Traders in the Market

The GameStop hearings in the House of Representatives on February 18th focused a lot on the Robinhood trading platform and the role of small investors in the markets. There is ample evidence that retail trading is booming, and the chart below illustrates how much of that trading involves options:

While there may be consensus about the growth of retail traders, it is less clear what that means for long term investors. The pejorative and widely held view among professional investors is that the small, individual investors are “dumb money,” that they provide liquidity and trading opportunities for the “smart money” doing the hard work. As we write above, however, we think it is dangerous to dismiss any meaningful part of the market as “dumb money,” and all investors should be mindful of these trends and their impact on stock prices and volatility – both in the short and long term.

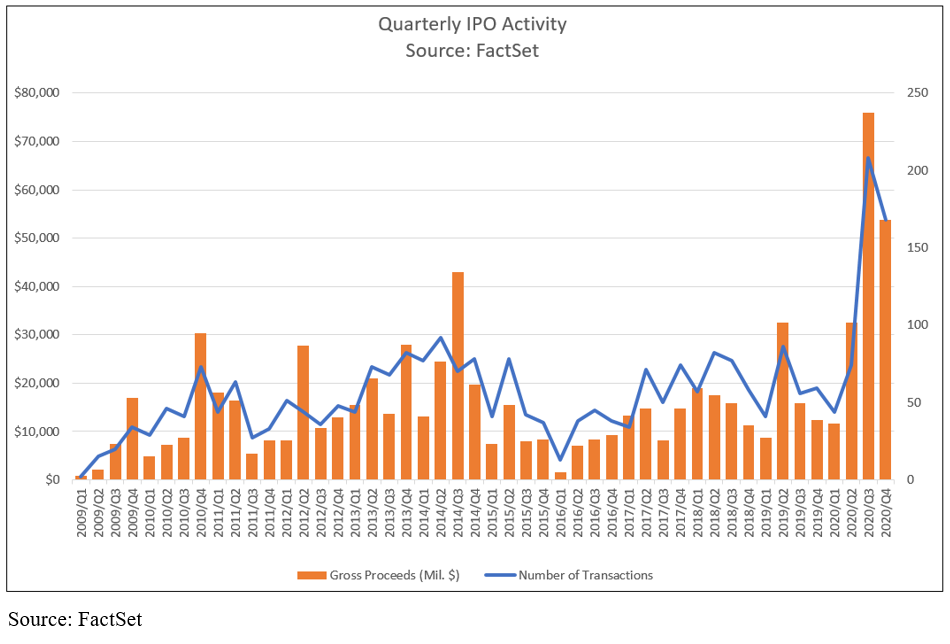

The IPO Market

We see another example of investor exuberance in the market for IPOs. According to the New York Times, more than 447 new share offerings and more than $165 billion was raised in 2020. This made it the best year for the IPO market in over twenty years based on data from Dealogic. To put those figures into context, in 1999, widely viewed as the IPO boom year of the modern era, 547 IPO’s raised roughly $167 billion in today’s dollars. Wall Street recently IPO’ed two companies – Doordash and Airbnb – with combined revenue of $5.8B, and investors were willing to pay a combined market valuation of $169B. Indeed, Airbnb finished its first day as a public company worth more than the combined value of Marriott, Hilton, and Hyatt.

When we think about the frenzy for investments in new technologies and the hunt for the next “unicorn,” we are reminded of a comment about early stage investing by one of our smartest managers during our investment due diligence meeting a few weeks ago. He observed that when the television was invented, you could have had the insight that one day every home in the U.S. would have a television set. That would have been a bold prediction at the time but you would have been right. However, that does not mean that every company that tried to manufacture televisions succeeded. The same thing can be said about e-commerce in the 2000s. The point is although excitement about a new technology – like electric cars or space travel – may be warranted, investing in the right company that can exploit it can be very difficult.

Closing Thoughts

COVID-19 ‘not necessarily the big one,’ WHO warns

- Washington Post, December 29, 2020

With the death toll from COVID-19 in the United States surpassing an astonishing 500,000, our hearts go out to everyone this terrible disease has impacted. The pain and economic suffering has been immeasurable, and our only hope is that we can use this experience to prepare for an even worse pandemic. As the new strains of COVID-19 demonstrate, a much more contagious variation of this disease can quickly mutate. We wrote above that we must challenge ourselves to imagine the unimaginable, and prepare accordingly. Since the first reports of the coronavirus began circulating over a year ago, the WHO and many epidemiologists have repeatedly warned that the world must prepare for even deadlier pandemics in the future. For that reason, we believe that some of the things we have learned to keep ourselves and others healthy and not spread disease should not be abandoned once the vaccine is available to everyone who wants it.

Finally, we cannot emphasize enough the risk of cyberattacks. Last March, a hacking team widely believed to be associated with Russian intelligence inserted malware in a routine software upgrade from a company called SolarWinds which offers network management solutions to over 300,000 customers. It is believed that approximately 18,000 companies and governmental agencies downloaded the malware. The scope of this attack and its ramifications on cybersecurity is almost impossible to fathom. If nothing else, it re-affirms the vulnerabilities of our critical cyber infrastructure and the imperatives of guarding oneself – and one’s family and assets – as much as possible. We are all at risk.

We welcome any questions or thoughts you may have. Please stay safe and well.

Sincerely,

Alternative Investment Management, LLC (AIM13)