AIM13 Commentary - 2021 Q3

“Named must your fear be before banish it you can.”

Readers of our letters often tell us that in these pages we dwell too much on risk and on what could go wrong rather than what could go right. Our response is… guilty as charged! Our strategy in hedged funds is to focus on risk and to avoid the permanent loss of capital. What these same readers fail to appreciate is that hedged investments represent only a portion of our overall portfolio. Would we have been better off on March 9, 2009 to put all of our capital in a long portfolio of stocks and enjoy a 600%+ S&P 500 return since then? Of course, but experience has taught us that markets do not always go up. The same readers who criticize us for often sounding too bearish often fail to recall long periods of broad market underperformance or to appreciate just how many land mines are out there right now. More on that below.

The third quarter saw significant intra-quarter volatility with S&P 500 TR gaining over 5% in the first two months, only to give it almost all back in September, at one point down (6.13%) from peak to trough. In September alone, the S&P 500 TR lost (4.65%). In periods like these, avoiding substantial losses is critical to compounding returns over time.

* * *

“I’m familiar with the fact that you are going to ignore this particular problem until it swims up and bites you in the ass!”

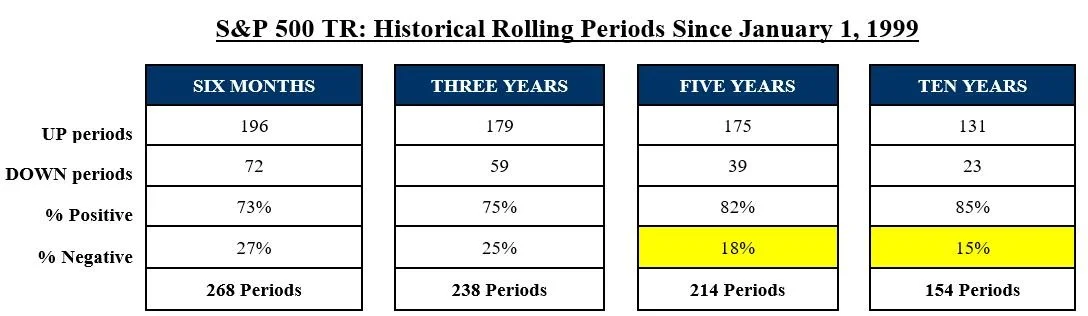

It is not often we can quote two of the greatest film franchises of our generation in one letter but both capture the essence of how we think about investing: Too many people are either unaware of the risks out there or just have a “hope and pray” strategy that they do not materialize. Indeed, investors often forget that there can be extended periods of negative returns. As the charts below demonstrate, over the last nearly 23 years since our first fund’s launch on January 1, 1999, there have been a number of extended time periods when the market was negative:

As much as we do not like to believe it, we have become “the older people in the room,” having experienced the great shocks of October 1987, 1990-1991, August-September 1998, 2000-2002, and 2008-2009. It is difficult to convey what it is like to live through periods like those in the markets. In fact, if you are younger than 35, you probably would not have been in our industry during the Great Recession or experienced any sustained market drawdown as an adult. Nor would you have seen the S&P 500 at the same level in December 2011 that it was in December 1998, thirteen years earlier.

Ray Dalio’s Bridgewater Daily Observations recently included the following observations that we think are relevant in this context:

“If we look back over the past 100 years, it has almost never been the case that a major equity market ended up being a top performer for two decades in a row. In fact, the typical pattern is that “winners” of a decade end up being the “losers” of the next. By the end of the decade, prices have been bid up and markets are extrapolating the same dynamics to continue. Often, success sows the seeds for its demise… So, when the underlying driving force slows or reverts, there is major disappointment that leads these past winners to underperform. While continued outperformance is not impossible, we are already seeing some of the U.S. tailwinds starting to reverse.”

-Bridgewater Daily Observations (September 13, 2021)

People often ask us where the market is going. We always say the same thing: We guarantee there will be a market correction, we just do not know when. This is an unsatisfactory answer for most investors since during a bull market, especially one that is in its later innings, risk seems very remote. Losing sight of risk, however, is what causes the permanent loss of capital.

“Denial ain’t just a river in Egypt.”

Where do we see real risks in the current environment that other people may be ignoring? The list is long and includes cyberattacks, terrorism (domestic and foreign), potential inflation, rising interest rates, aggression from Iran or Russia, and several threats coming out of China (including a conflict with Taiwan). One thing we have seen many times is that the risk that no one is talking about is the one that materializes. Not many people could have imagined two years ago that a global pandemic would kill over five million people and destroy hundreds of millions of jobs. The same can be said about September 11, 2001. Many people warned about both things happening, but as Richard Dreyfuss observed in Jaws, people just do not want to believe something terrible can happen until “it swims up and bites you in the ass.” For this reason and for this portion of our portfolio, we stand by our conviction that downside protection is critical to generating returns over time.

* * *

Hedge funds and 2021: Although we frequently remind people not to focus on short term returns, 2021 has been challenging for some hedge funds. We realize underperformance for many has almost entirely been due to the “meme-stock rally” in January, but on both an absolute and relative basis, performance this year for funds affected by that event has fallen short of investors’ objectives.

One of our most esteemed managers, who never has had a down year in his 30+-year career and is down year-to-date, noted recently that what happened in January demonstrated a new dynamic for managers who short stocks. Unlike the internet craze of the late 1990’s, many companies with elevated valuations are raising huge amounts of capital. In fact, we are on a pace to match last year’s record of $290 billion raised in stock sales (both registered and unregistered). The high valuations across the board have given the high quality companies the ability (when needed) to raise capital to make aggressive strategic decisions for future growth. On the other hand, weaker companies have also had the ability to sell their stock at prices that we believe they will never be able to justify. Short sellers continue to face valuation head winds that we believe will ultimately play out in their favor over time. In this environment, short sellers need to have a deep, accurate thesis combined with the ability to sometimes fight through a longer than expected time frame to be able to monetize their short ideas. As we have discussed in the past, these difficulties have scared many investors away from shorting and have shaken others to close their positions out at an inopportune time. We believe that experience, a repeatable rigorous alpha generating process, and the ability to have a longer time horizon will serve our managers well during the next cycle.

Due Diligence Tip: The Convergence of Public and Private Investing.

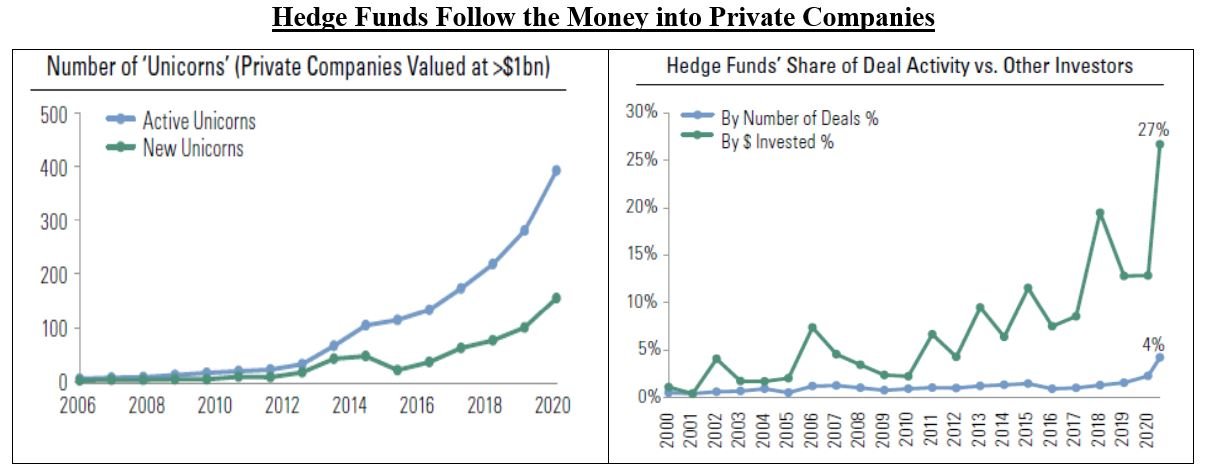

One of the more significant developments for hedge funds recently has been the increase in investing in later-stage private companies. In September, Goldman Sachs issued a report discussing this trend entitled “Hedge Funds and the Convergence of Private and Public Equity Investments” which included these charts:

Source: Goldman Sachs

As a part of this dynamic, several hedge fund managers are increasingly relying on privates to generate returns. In fact, private company investments have significantly “eased the pain” of an otherwise rocky 2021 for some hedge funds, allowing those managers to mask underlying poor performance on the public equity side with higher risk, less liquid trades in private equity. This just reinforces for us the importance of understanding not just what you make, but how you make it when it comes to analyzing hedge fund returns.

The Goldman Sachs report noted that there is no “free lunch” in private investing since, among other things, the mix of liquid, public investments with illiquid, private investments can create a liquidity asset-liability mismatch. If the manager is not structured to address this issue, there is a huge embedded liquidity risk, as we saw in 2008-2009. Managers try to mitigate this risk with various “crossover” structures, including side pockets inside the portfolio, “liquidation interests” comprised of illiquid positions distributed to redeeming partners, and illiquid elections where investors can decide how much illiquid exposure they want. Such approaches can be far from perfect. Investors need to be wary of the risk of being forced to hold illiquid investments indefinitely, while fees and expenses dilute away any long term returns. Aside from liquidity concerns, other risks include a white hot IPO market that has the potential to cool quickly and rising rates that will make it harder for emerging companies to finance growth.

At AIM, we have always recognized the benefit of investing in both the private and public equity markets. When it comes to manager due diligence, there are similarities and differences. However, we believe having invested in both spaces for decades provides us with a unique perspective on the benefits of a manager expanding its toolkit in this way, just so long as the manager has the necessary skill set and experience.

Market Observations

On November 8th, the S&P 500 TR notched its 63rd record close of the year. With under 30 trading days left in the year, we are within striking range of the most market records ever in a single year, which was 77 in 1995, according to CNBC. In late September, the S&P 500 TR dropped more than 5% from its high – and that was a full 227 trading days since its previous 5% drop. According to Barron’s, that represents the fifth-longest such streak on record, with the S&P 500 TR gaining 29.4% during that period. In this context, it is not surprising to see charts like this:

As we alluded to above, we view these statistics as more evidence of an unusually frothy time in the markets, and it cannot go on forever. However, that is not the only thing that keeps us up at night:

Disruptions in energy supply: More and more institutional investors are banning or eschewing investments in fossil fuels, and the decrease in spending on energy development has contributed to a global energy crunch. This portends a particularly challenging winter and more disruptions to the global supply chain. In Europe, natural gas prices hit an all-time high in September, tripling from June to October alone. Svein Tore Holsether, the CEO of Yara, one of the world’s largest fertilizer producers, said recently that it is now too expensive to produce the product. This can cause a ripple effect on food production, and Holsether has warned, “I’m afraid we’re going to have a food crisis.” In China, some authorities have banned the use of elevators in office buildings for the third floor or below and households go for days without power, according to a report in The Guardian in October. We are told that the Chinese leadership is especially concerned since energy drives employment, and an under-employed workforce in China may lead to social unrest.

Chinese amassing genomic data: We often talk about the threat from China in these pages, though largely in the context of cybersecurity, espionage, or broader geopolitics. A new threat was recently brought to our attention that only adds to our concerns. China has been quietly gathering enormous amounts of genetic code by acquiring stakes in U.S. genomic sequencing companies like 23andme, partnering with U.S. hospital chains to provide cheap genomic sequencing services, and even supplying COVID-19 tests. “China has amassed the largest genomic holdings of anywhere in the world,” said Anna Puglisi of Georgetown’s Center for Security and Emerging Technology at a Senate hearing recently. Biotech data is critical for national security since it drives the production of vaccines, the development of engineered foods, and advances in medicine and healthcare. Falling far behind the Chinese in this area only further weakens our standing on the world stage, and its consequences cannot be underestimated.

The new era of debt monetization: We are spending more than we are earning, and that has huge implications for the markets. With zero interest rates and ever more money supplied by central banks, the value of money devalues and no one wants to hold cash. In other words, “cash is trash,” according to Ray Dalio. This has obvious implications for inflation, and equity markets have been the prime beneficiary. Yet it cannot last forever. Eventually, interest rates must be lower than inflation rates and below the nominal growth rate in order to deal with all of that debt in order to finance it. Even private equity firms are piling on debt to pay dividends. According to a recent Wall Street Journal article, companies backed by U.S. private-equity firms have taken on $58.5 billion in dividend-recapitalization debt this year through October 20, 2021. That is more debt than 2019 and 2020 combined.

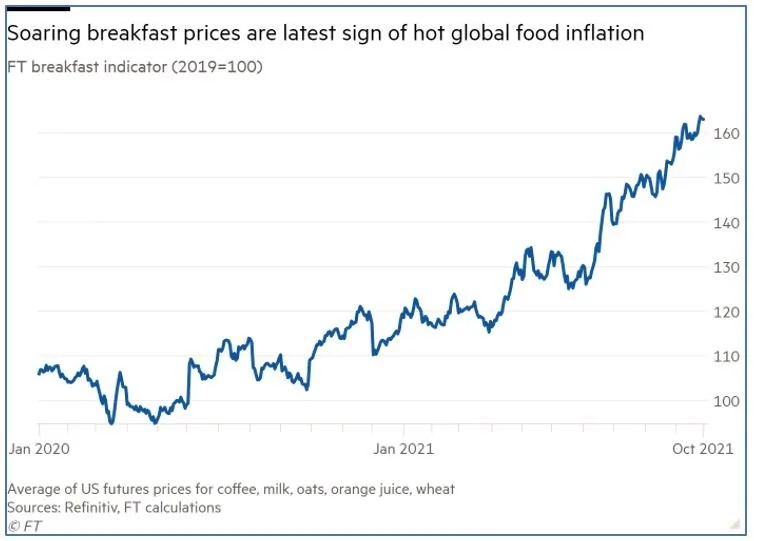

Inflation – and the soaring cost of breakfast: Those of you who come to visit us in New York know that there are few things we like better than a good breakfast. However, when the tab for a recent breakfast for two topped $100, we realized that all of the talk about inflation – which reached a 30-year high in October – was really hitting home. The Financial Times actually tracks the cost of breakfast based on futures prices for food commodities that make up a typical breakfast and published this chart in late October:

Source: Financial Times

With the cost for a breakfast up 63% since 2019, the only silver lining is that it might help our waistlines to cut back a little on our favorite meal!

Closing Thought

While we have had a presence in our office since the early days of the pandemic, starting this spring, we methodically phased in having the team back for a majority of the work week. New “virtual” tools have helped us to be more efficient. With a flexible approach, we continue to take advantage of saved commuter time, broader participation internally in manager meetings, and more efficient manager due diligence. For example, we can “meet” managers in London in the morning, in New York City at midday, and in San Francisco that same afternoon without having to go through airport security.

As we have said since the onset of the pandemic, we invest our own capital and that of our partners with people, not faceless organizations, and in our view video conferencing, even with its benefits, will never be a perfect substitute to in-person interactions, either in the form of collaboration within our team or in meetings with our managers and our partners. We are not sold on the dawn of a new age of a fully office-less workforce. That said, we see a path forward that makes us a better firm than we were before the pandemic by leveraging new tools and newly accepted practices to improve our investment due diligence and enhance our team’s development.

We welcome any questions or thoughts you may have.

Sincerely,

Alternative Investment Management, LLC (AIM13)