AIM13 Commentary - 2021 Q2

“Do not learn how to react. Learn how to respond.”

The last eighteen months have been a roller coaster, not only in the markets but also in everyone’s lives as we continue to navigate the first national pandemic in our lifetimes. We can draw many important lessons from the experience, but one lesson in particular stands out for us as investors: we must always be deliberate and not panic. We think this is what Gautama Buddha meant nearly 2,500 years ago in the quote above – that there is a critical difference between reacting versus responding to events as they unfold around us. Too often investors immediately react and make knee-jerk decisions.

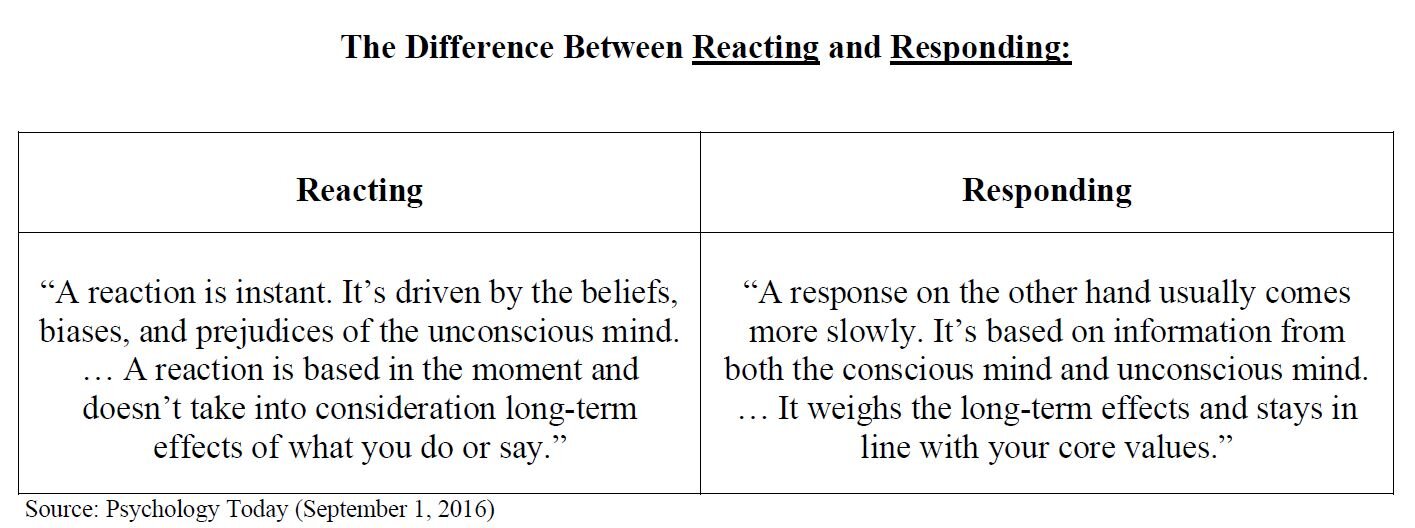

When we compare the definitions of reacting and responding, we see an important nuance that we believe is critical to investing. A blog we came across put it this way:

“When we react, many times it is instinctive, reciprocal or in opposition to a particular situation or person... Responding, while technically a reaction, takes into consideration the desired outcome of the interaction. A reaction may result in a positive or negative outcome whereas a response is engineered to produce a positive or negative outcome. Reacting is emotional, responding is emotional intelligence.”

Many investors fail to appreciate this distinction when managing their investments and often react impulsively on instincts in the immediate aftermath of some development rather than making decisions that combine instincts with facts. When it comes to recent manager performance, one way we try to respond versus react is demonstrated after periods of either outperformance or underperformance. We believe that an integral part of successful investing with managers over the long-term is to trim when they are up and add when they are down – as long as the manager’s strategy has not changed. Our long-term results, in our view, come from being disciplined in this regard. Of course, there are instances when a sudden drawdown signals that a manager may be taking on more risk or panicking, and indeed the right decision is to redeem. However, no manager can sustain an uninterrupted run of outperformance, and likewise great managers do not “go dumb overnight.”

We believe managing a portfolio this way yields better results OVER TIME. One metric we look at in this regard is the “internal rate of return” (IRR) used in private equity. Private equity investors use IRRs to reflect the timing of flows and to compare a manager’s performance with the opportunity cost of capital. However, a private equity investment is committed and ultimately it is the multiples on investments that matter most (and so goes the saying, “you cannot eat IRRs”). While one cannot “trade” in and out of funds on a regular basis, we always look for opportunities when a manager is down to add along with being disciplined about taking profits off the table as we have done with the manager mentioned above. This strategy typically allows a fund investor to outperform the hedge fund manager’s fund returns.

As we have written in the past, historically many investors chase returns by adding to funds that have posted outsized returns while redeeming from managers who more recently underperformed. Viewed from an IRR perspective, their overall investment returns often significantly underperform that of the underlying funds. It is simple math, adding after up periods and redeeming after down periods can produce inferior returns.

“Past performance is not necessarily indicative of future returns.”

Unfortunately, in this respect, investors can be their own worst enemies. On July 23rd, the Wall Street Journal published an article by Jason Zweig about these dynamics entitled, “Why Investors Can’t Kick the ‘Past Performance’ Habit.” Zweig cited research by Meir Statman of Santa Clara University that found that the proportion of investors who expected stocks to go up over the coming six months rose on average by 1% with every 1% increase in the S&P 500’s returns for the prior month. As Zweig put it, “It’s as if investors believe the medium-term future is shaped by the short-term past.”

For this reason, as we discuss more below, in the wake of the market’s recent strong past performance, many investors are abandoning shorting – which is fine if one thinks that this market is going to go straight up. We do not think that; in fact, we believe there will be increased volatility as we continue to live with the pandemic, China overtaking the U.S. as the world’s largest economy, cyber threats, and many other things that unfortunately none of us is thinking about. Now is the time to have patience and not abandon shorting. However, if one thinks that there will not be volatility, then “hedged” funds are not the right strategy.

“Engage your brain before you engage your weapon.”

When thinking about recent past performance, anyone allocating to hedge funds knows that even the greatest investors experience drawdowns. We believe that it is imperative to constantly re-evaluate managers that are not only down but also those that are up and those who are in between – that is, all of our managers, regardless of recent performance. We believe that those drawdowns are often an opportune time to add. On the flipside, being disciplined in trimming from a manager who has dramatically outperformed has tended to add to overall returns over time. Staying focused on a manager’s ability to generate returns in the future requires disciplined ongoing due diligence where we constantly are asking ourselves, if we were not invested in the manager today, would we invest? This simple approach eliminates the emotional reactions that investors typically have after great past performance or recent underperformance. Too many times, investors use a rearview-focused approach that fails to assess the manager’s ability to perform going forward – which is all that matters – and can greatly impair actual returns (net IRRs) over time.

“If you cannot control your emotions, you cannot control your money.”

We often see the emotional, return-chasing mentality with professional, as well as retail, investors. Reports prepared by some professional advisors and provided to investment committees often include a list of managers and their historic returns for the prior month-to-date, year-to-date, last twelve months, three years, five years, etc. When the advisor adds a manager, their full prior track record goes on the report. For that reason, there are some advisors who would prefer to add a manager who outperformed rather than underperformed recently, even though the investor’s portfolio was not invested in that manager in that period. Similarly, some advisors tend to redeem from managers that are down simply because they do not want any under-performing returns on their quarterly reports sent to clients. For us, this is the definition of investing using the rearview mirror.

“How should we judge fund performance? Only thorough evaluation can lead to the right answer. Complex, multi-dimensional analysis is required. No one number can be relied on to produce a proper conclusion.”

Another dynamic we see in considering manager returns is choosing arbitrary start and finish dates when looking at track records. This can sometimes be misleading. A short-term investor considering a fund on the basis of a trailing 12-month return may see very different results simply shifting the time period a couple of months and allowing either particularly strong or weak months to drop off the period. Had the merits of the investment changed in those months? Of course not. Yet too many investors make decisions using short term data points – just numbers – rather than making a more holistic assessment. As Plato once said, “A good decision is based on knowledge and not on numbers.” We believe that quantitative analysis is an important part of manager due diligence, but attaching too much significance to one data point can distort one’s view of an opportunity.

“Set your course by the stars, not by the lights of every passing ship.”

Last quarter, we discussed the “noise” of data in the information age and how it can be an impediment to making good investment decisions. In a similar way, “real time” information can impel investors to take immediate action, which does not allow time to digest and consider – or in other words, to react versus to respond to something. These first two quarters of 2021 have been a very difficult time, and staying focused and disciplined is not easy. In fact, it takes enormous patience, which is in short supply among many investors today. However, we believe that by setting the course on things that are fixed, like some of the principles of investing discussed above, and not on passing things like emotions, impulses, and “reactions,” will serve us better over the long-term.

* * *

thoughts on shorting

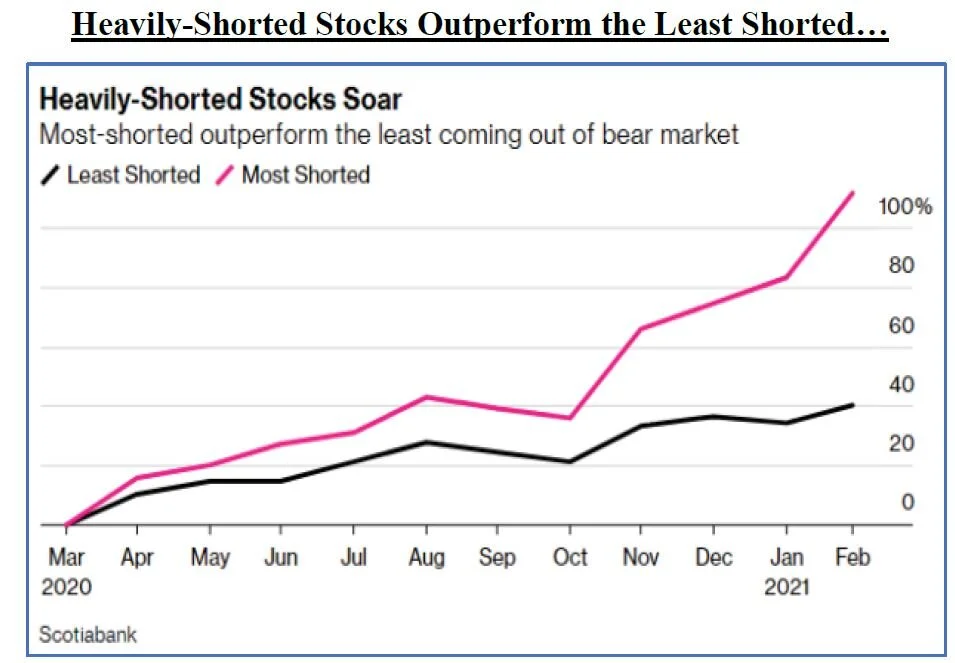

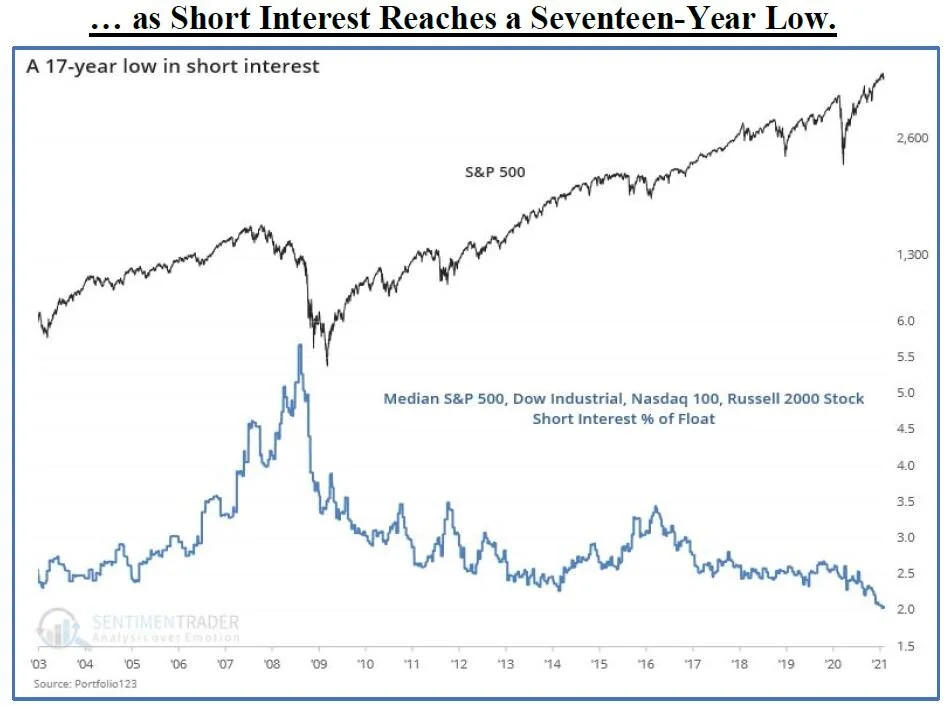

A lot has been written in the wake of the GameStop turmoil about whether shorting stocks remains an effective tool to protect capital. It certainly has been a challenging time for short sellers. One of our managers described the earlier part of this year as “the most difficult short selling tape we had seen in our collective careers.” Indeed, many short sellers have thrown in the proverbial towel. Scott Fearon, President at Crown Advisors Management and a prominent short seller, said that the GameStop saga marked “the death of the entire efficient market hypothesis that says that all stocks reflect all public information at all periods of time.” While that might be a bit hyperbolic, the charts below illustrate the difficult current environment shorting stocks:

Source: SentimenTrader and Portfolio123

Reinforcing this point, Goldman Sachs reported in August that short interest in the median S&P 500 stock also dropped to 1.5%, matching the record low near the peak of the dot-com bubble, which they noted was “a sign of bullish sentiment but also potentially a sign no one quite knows what to bet against at this moment.”

Portfolio managers have blamed the challenge of finding good shorts recently on a macro environment of excess credit propping up underperforming companies and a heavy rotational market that makes no distinction between good and bad stocks. In addition, borrow rates have risen dramatically, especially for less liquid stocks that are popular short-sale candidates. For example, shares of the electric vehicle start-up, Arrival, featured a borrow rate of nearly 80% recently, according to research published by The Motley Fool. That means a short seller borrowing $10,000 worth of shares would need to pay fees of almost $8,000 per year to maintain the position. Most short sellers do not hold their positions open that long, but even if the short seller turns out to be right about the direction of the stock, the fees can eat heavily into any profits. Finally, a short seller also always runs the risk of a short squeeze. A manager can announce a short thesis, and then traders look to push the stock up, knowing the short seller will eventually need to close the position, at which point the squeeze has achieved its purpose.

On top of a challenging market and trading environment for short sellers, on June 4, 2021, FINRA, the organization that regulates broker-dealers, proposed new rules regarding short disclosures likely in response to all of the scrutiny surrounding the market volatility involving shorts. The FINRA proposals could increase the transparency of short positions existing in the prime brokers’ client accounts, to include synthetic short positions established through derivatives and arranged financing/enhanced leverage programs. The SEC has also announced that it is considering whether to require market participants to disclose short positions directly to the SEC.

Bloomberg Businessweek, June 26, 2021

What does this all mean to us as investors? Like we said above, if one believes that the markets will continue to go straight up, there is no reason to hedge. However, for the portion of our overall portfolio in our “hedged” strategy, we believe shorting is critical to protect capital in down markets. With the market up over 15% year to date and the S&P making history on July 9th with seven straight scoring records, many investors are just not thinking about downside protection. We remain confident, however, that bear markets will return and long-only, unhedged strategies will significantly underperform. Our job of finding managers who can short well is more difficult than ever, however we believe our 20+ year experience provides us the ability to identify and access truly “hedged” managers who still can find productive single name shorts. This will be critical when the market turns.

market observations

“We believe the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals… Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.”

In a year when a company actually tells its investors that its own stock price is “unrelated to our underlying business, or macro or industry fundamentals,” those of us who are old enough to remember think back to the dot.com boom or the Great Financial Crisis. Yet AMC is not alone. Since the end of March, almost 100 unprofitable U.S. companies have raised money through secondary offerings, twice as many as coming from profitable firms, according to Bloomberg. In fact, as the chart below indicates, the previous two periods in which unprofitable firms dominated the pool of equity offerings, the S&P 500 Index was either at the start of a bear market, or already in one:

Source: Bloomberg, Sundial Capital Research, June 27, 2021

“That perhaps points to companies getting greedy,” Mike Bailey, Director of Research at FBB Capital Partners, recently told Bloomberg. He added, “Anytime you have a bunch of selling by desperate companies, that could be a signal we’re closer to a top than a cyclical bottom.”

Other things we are concerned about include:

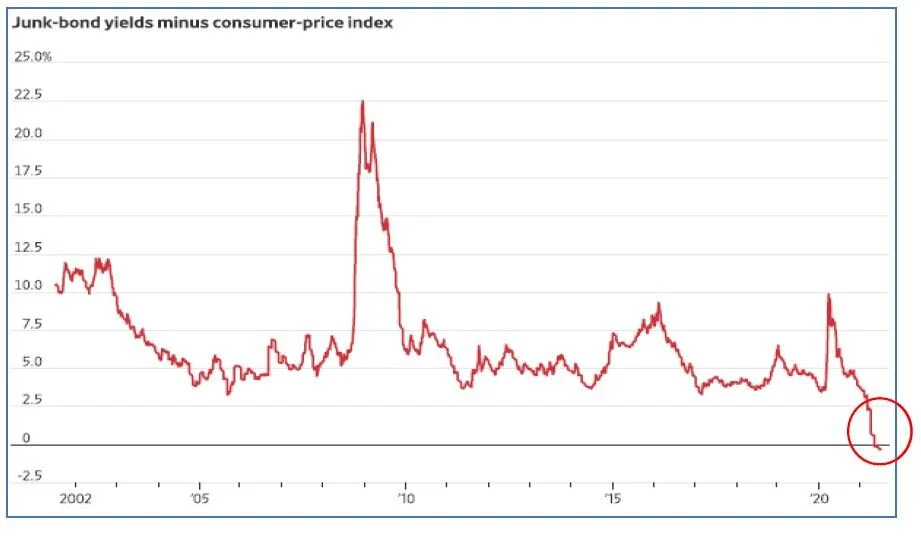

Junk Bonds: According to a report on CNBC in mid-July, for the first time in the recorded history of bond prices, the return that investors receive for investing in the riskiest U.S. companies fell below inflation:

Source: Bespoke Investment Group, as reported by the Wall Street Journal, July 9, 2021

At the same time, the U.S. distress ratio, which is the proportion of speculative-grade bonds yielding at least 10 percentage points more than Treasuries, fell to 2.62% in May, the lowest level since October 2007, according to S&P Global Ratings. As reported in the Wall Street Journal, Gennadiy Goldberg, the U.S. Rates Strategist at TD Securities, said the inversion indicates investors are chasing returns far and wide in a low-rate environment, even in riskier places. “This is a function of too much cash in the system and too few attractive assets for investors to put their cash into,” he said.

Cybersecurity and the Microsoft Hack: Two trends we have been watching closely – increasing hostilities between the U.S. and China and the spike in cyberattacks – converged recently as the U.S. directly accused China of hacking Microsoft. This accusation represented the first time the U.S. openly suggested that the Chinese government had hired or quietly condoned criminal groups to carry out the attack, according to The New York Times reporting. On July 19th, the FBI and the Cybersecurity and Infrastructure Security Agency (CISA) issued a Joint Cybersecurity Advisory outlining the tactics, techniques, and procedures China’s state-sponsored cybercriminals use to breach networks. While it is required reading for people who manage data center network security, all of us are well-advised to prioritize cybersecurity given the growing threat of state-sponsored cyber insurgency.

Inflation: In July, the Labor Department reported that consumer prices rose 0.9% in May and 5.4% over the past year – the biggest jump since 2008:

The prevailing wisdom is that surging inflation is “transitory,” with many economists blaming it on widespread shortages that have disrupted the global supply chain and on pent-up demand among consumers following the pandemic. However, the Fed Chair, Jerome Powell, admitted in June that economic forecasting is “a highly uncertain business.” Indeed, on July 27th, the IMF warned in its latest World Economic Report that “transitory pressures could become more persistent.” If the Fed and the White House are wrong and higher prices are not a passing phase, most observers agree that sustained, higher inflation could shorten the economic cycle and abruptly end the current stock market boom.

closing thoughts

We remain relatively far more concerned about COVID-19 than many people we talk to, and the Delta variant trends unfolding as we write this letter only add to our concern. We cannot offer any particular insight or science on this subject that readers cannot find elsewhere, however we are of the view that the fall will bring challenges that seemed largely behind us when the vaccines became widely available this spring. With the waning effectiveness of vaccines after six months – which many of us received in the March-May timeframe – occurring at the same time people return indoors, schools open, and the traditional cold/flu season begins, we believe we are facing another period where the safety of many, including those unvaccinated because they are too young or have existing conditions, are at risk. We continue to believe some of the experts who feel this will taper off and encourage everyone to not let their guard down. Unfortunately, this will be something to live with going forward, and we continue to tell our family, friends, partners, and employees to err on the side of caution when it comes to taking steps to protect one’s family, loved ones, and even those we encounter each day. We have come so far, but it is still important to reduce the spread of the virus since with more spread comes more variants.

Lastly, as we approach the 20th anniversary of the September 11, 2001 attacks, the poignancy and freshness of that tragedy is all the more acute amid the heartbreaking scenes coming out of Afghanistan. It is trite to say, but we must never forget what happened twenty years ago, nor ever convince ourselves that such a thing “could never happen again.” Terrible things like 9/11 do happen, and the passage of time cannot cause us to abandon the lessons we have learned. At the very least, we owe it to the victims of that awful day and the heroes who have sacrificed so much to keep us safe ever since, both here and abroad, never to let our memory of them fade. Our constant vigilance is the best testament to their legacy.

We welcome any questions or thoughts you may have.

Sincerely,

Alternative Investment Management, LLC (AIM13)