AIM13 Commentary - 2025 Q3

“If you can’t spot the sucker in your first half hour at the table, then YOU are the sucker.”

As investors, one of the biggest problems we see today is a misalignment of interest between investors and managers. Unfortunately, many managers do not align investors’ interests with their own. We are not naïve in thinking that managers should be altruistic and not seek to make money for themselves. However, if enriching themselves and growing assets as fast as possible are the top priorities, the interests of investors and managers will diverge. The reality is that many managers take advantage of their LPs. To those investors whose money they manage, we can only say, “You are the sucker!”

GP’s and LP’s are not always rowing in the same direction…

Source: AIM13; ChatGPT

When it comes to a misalignment of interest, below are some telltale signs that a manager does not share the same goals as his or her partners:

“What counts is not necessarily the size of the dog in the fight –

it’s the size of the fight in the dog.”

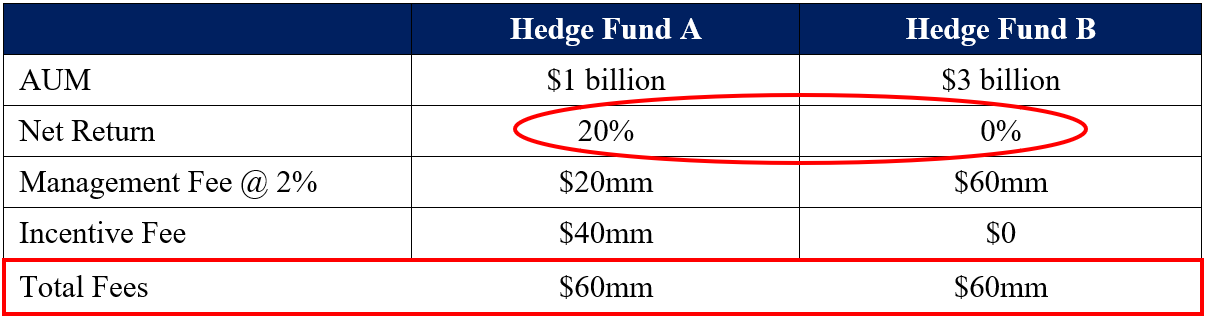

Focusing on size, not returns. The first question many investors ask a manager is, how much money do you manage? That is the wrong question. It should always be about the manager’s net returns. Managers whose primary goal is to grow assets – by attending every cap intro conference they can find, appearing on CNBC, hiring a team of fundraisers who peddle glossy materials and videos, etc. – are not spending time making money for their investors the old fashioned way, i.e., working hard to find great investments.

At AIM13, we limit our fund sizes and at times return capital. As we have a lot of our personal net worth in the funds invested alongside our partners, we are more focused on returns than on fees. That is not the case with many managers, who when faced with the option of running more money and a lower return would choose that over managing less money with greater returns.

Bigger Doesn’t Always Mean Better… Unless You’re the General Partner

Smaller Fund/Greater Returns versus Larger Fund/Lower Returns

“A-B-C… Always be closing.”

Constantly selling new funds and new strategies. Like a watch salesman in a trench coat, we are seeing firms build out a wide variety of strategies to please every type of investor. But when you try to please everyone, you end up pleasing no one. We were shocked to hear recently that there are now more private equity funds in North America than there are McDonald’s franchises, according to KKR & Co’s co-CEO Joe Bae. Many managers are too frequently rolling out new vintages of funds or are pitching investors a whole smorgasbord of investment options that span the capital stack (debt, equity), duration (from daily liquidity to 10-year funds), stage, etc. We view this as a huge red flag.

Exploiting expense provisions aggressively to reduce overhead costs. We always ask for gross returns (ex-fees and expenses) when analyzing a manager and have been shocked (sickened!) too many times by the spread between gross and net returns. We are happy to pay reasonable management fees and (more so) incentive fees, but many managers use “other people’s money” in their funds to pay for things like private plane travel, lavish investor conferences, “consultants” who really are employees, and other things that should be coming out of the management fee. We want our managers to make money primarily through incentive fees and not through the “other expenses” line we see every year in their audit. For more thoughts on these and other bad manager practices, please see the following links on what to avoid when due diligencing private equity and hedge funds (It Is (Still) Time for LP’s To Be Accountable...; A Hedge Fund Investor's Call to Action).

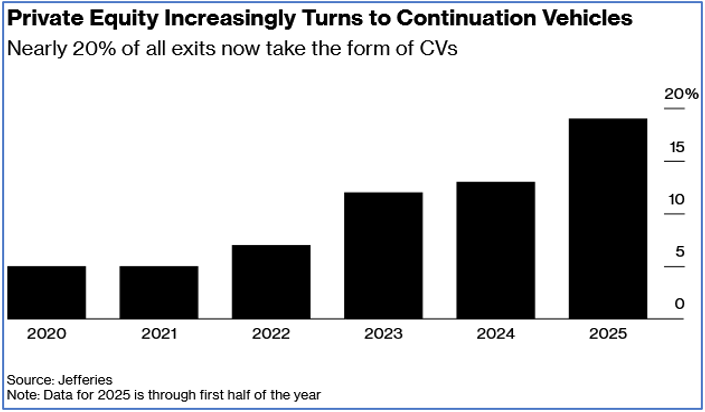

Using continuation vehicles and secondary mark-ups to generate more fees. We have seen a huge spike in continuation vehicles (CVs) in private equity as managers resist exiting portfolio companies in favor of transferring the asset to entities often with an indefinite term.

“Private Equity’s Latest Financial Alchemy Worries Investors”

Source: Bloomberg

While a CV may make sense in some circumstances, many managers are just looking to line their pockets with more management and transaction fees. In many cases, the managers can take carry twice, both at the time the asset is moved into the CV and again when it is realized, which creates conflicts on interest around valuation. Even worse, as reported by Jason Zweig in the Wall Street Journal in June, some publicly traded secondary funds are now taking incentive fees at year end on both realized and unrealized gains. Given that the average secondary fund buys primary funds at an 11% discount to NAV, the secondary manager can take its carry simply on the asset being marked up to its NAV. We think that is outrageous!

* * *

“They f**k you at the drive-thru!”

“They know you’re gonna be miles away before you find out you got f**ked! They know you’re not gonna turn around and go back, they don’t care!”

We used Joe Pesci’s rant above back in 2019 in the context of doing your due diligence (i.e., check the food before pulling away!). But it works even better here: Many fast food sellers do not really care that you get tuna rather than a hamburger. They only want your money and you out of their drive thru. The same can be said of managers who take advantage of their investors just to enrich themselves. Do not be their sucker!

Market Observations

“Too often we enjoy the comfort of opinion without the discomfort of thought.”

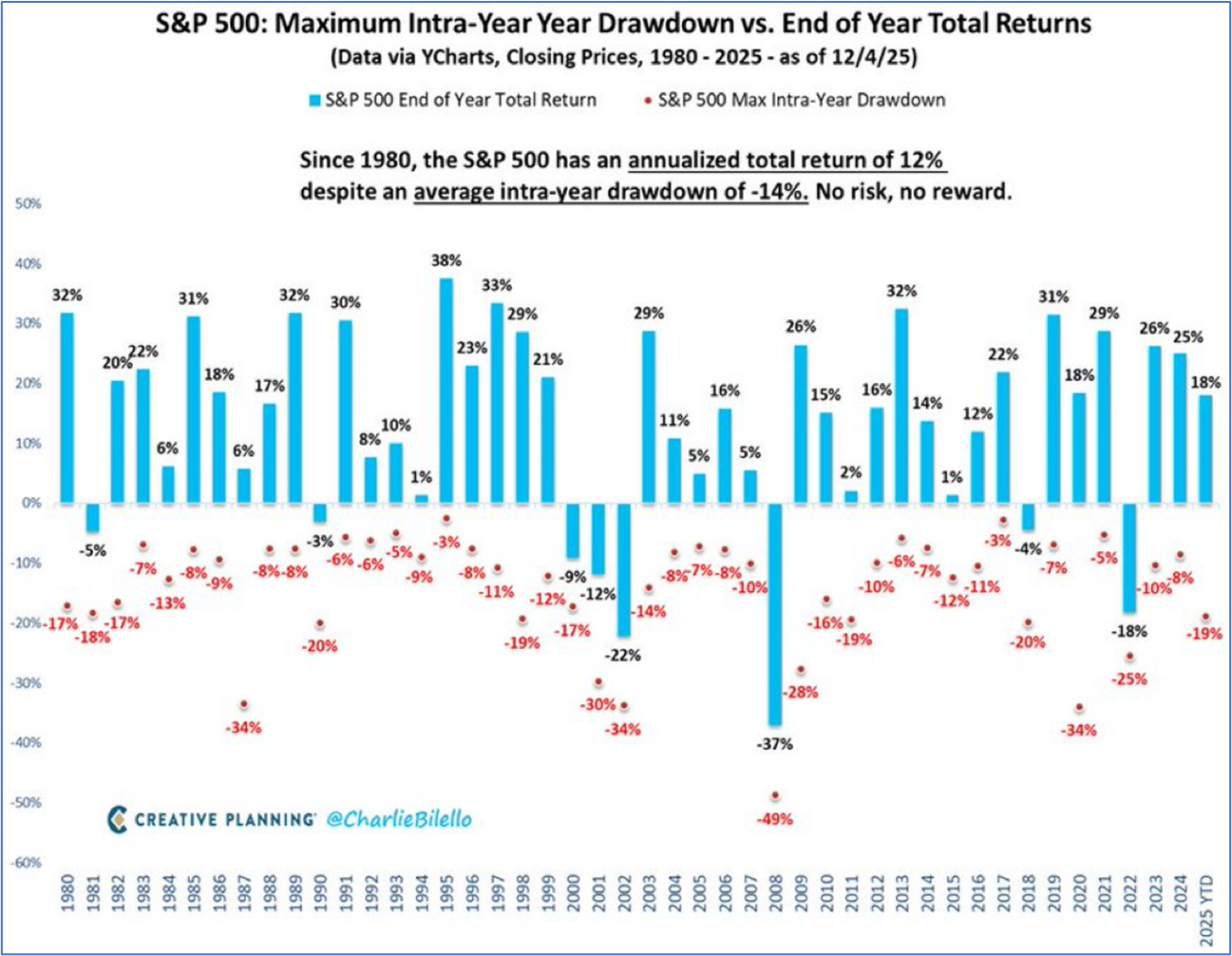

Many investors have not experienced a deep, prolonged decline in the markets. Indeed, if you take voting age as the measure of adulthood, any investor under the age of 35 did not experience the GFC as an adult. These investors and others whose short term memory of the market is just of one that seems to go straight up overlook that there is no upside without downside, no reward without risk. Charlie Bilello recently released the chart below that illustrates this wisdom:

That is important to keep in mind as we approach the end of the year with high teen returns in the S&P 500.

With that backdrop, here are few things that keep us up at night:

Valuations in “Nosebleed Territory”. In early November, Spencer Jakab writing for the Wall Street Journal reported on one metric of the market that paints a scary picture. Known as the Shiller P/E Ratio or the CAPE (Cyclically Adjusted Price-to-Earnings) Ratio, the metric measures stock market valuation by dividing the current stock price by the average of the last ten years' inflation-adjusted earnings, smoothing out business cycles to better show how expensive the market is. This ratio recently broke 40 for only the second time ever:

Source: Prof. Robert Schiller, Wall Street Journal, Nov. 4, 2025

This measure is not the only one flashing warning signs: As of late October, the S&P 500’s multiple of sales was higher than at any point in history, including at the peak of the tech-stock bubble, according to the Wall Street Journal.

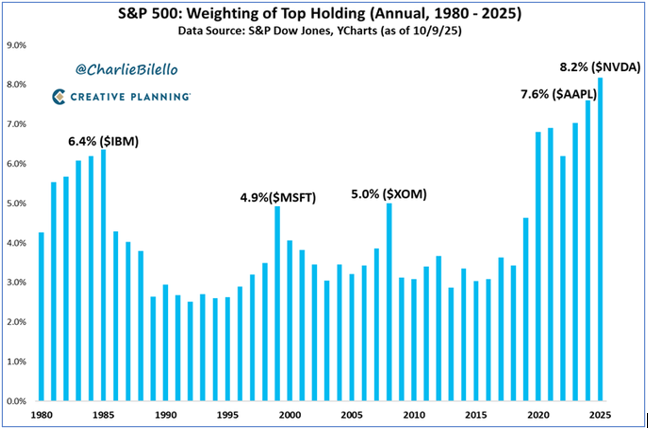

Market concentration. Much has been written about the dominance of the “Mag Seven” (or its variants) over the last few years, but it bears repeating that the S&P 500 has essentially turned into a ten-stock story. As reported in the Economic Times in early November, approximately 42% of the index’s total value is concentrated in just ten stocks, breaking every record in modern market history and surpassing the Dot-Com’s 29% peak. Put differently, almost half of America’s benchmark stock index depends on a handful of mega-cap tech giants, a level not seen since the 1930s. Moreover, one stock alone – Nvidia – represented over 8% of the S&P 500’s in early October:

Source: Charlie Bilello

“75% of gains, 80% of profits, 90% of capex – AI’s grip on the S&P is total and Morgan Stanley’s top analyst is ‘very concerned.’”

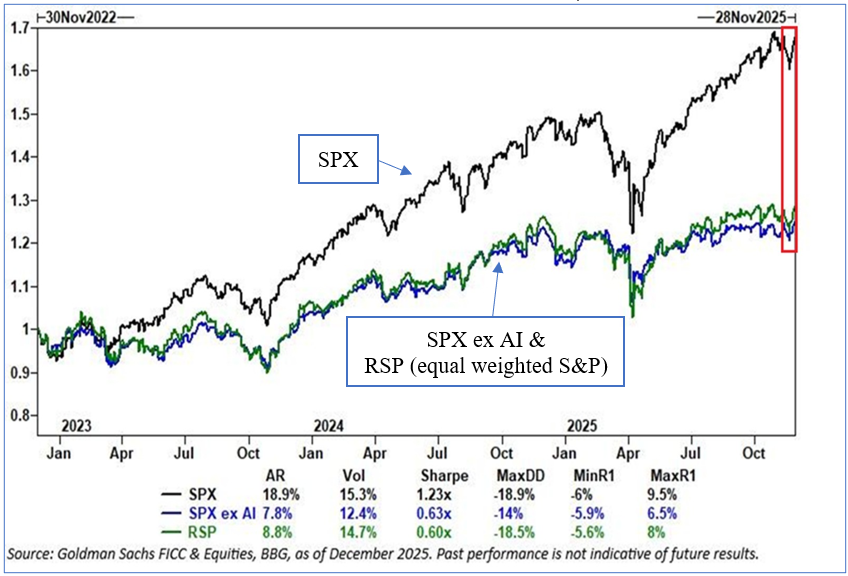

The AI trade distrorting market returns. We wrote last quarter about the risks and opportunities associated with Artificial Intelligence, and we continue to believe there are enormous benefits to be gained by the new technology. The fact that Time recently named the architects of AI to be the “Person of Year” shows just how widespread its impact has been. What is less discussed is how the investment in AI could be distorting how people view recent market returns and the health of the economy. Some people even believe that without the AI investment, the US economy would be in a recession. The chart below shows the divergence between AI stocks and the rest of the market since ChatGPT went live:

Excluding AI names, the S&P 500 has gained +25%

since the launch of ChatGPT on November 30, 2022.

Source: The Kobeissi Letter

For an excellent assessment of AI in the context markets and investing, we highly recommend Howard Marks’s most recent memo, “Is It a Bubble?”, available here: https://www.oaktreecapital.com/insights/memo/is-it-a-bubble.

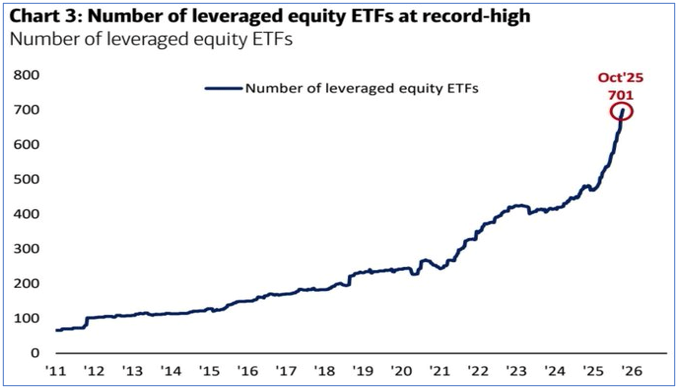

Explosion of Leveraged ETFs. With the markets churning out strong returns the last few years, many investors are using record amounts of leverage to amplify their gains. Historically, investors primarily used margin loans to gain leverage on their investors. More recently, leveraged ETFs allow investors to employ leverage in one vehicle, and their popularity is soaring:

Source: Bank of America

In November, the SEC paused the review of proposals for new highly leveraged ETF’s from several fund managers and sought more clarity on the risks tied to the products, as reported by Reuters on December 3. “We write to express concern regarding the registration of exchange-traded funds that seek to provide more than 200% (2x) leveraged exposure to underlying indices or securities,” the regulator said. Even in a surging market, the performance of some of these products has been terrible: As of early December, the Defiance Daily Target 2x Long MSTR ETF (MSTX.O) has plunged more than 83% this year. An ETF (SMCX.O) tracking twice the performance of Super Micro (SMCI.O) has dropped more than 60%, while the 2x long cannabis ETF (MSOX.P), is down 59.4%. As we have said many times before, leverage is the quickest way to turn a large fortune into a small one.

* * *

We welcome any questions or thoughts you may have.

Alternative Investment Management, LLC (AIM13)